Question: please use excel formulas so i can check my work 1-Frame inc. manufactures bamboo picture frames that sell for $25 each. Each frame requires 4

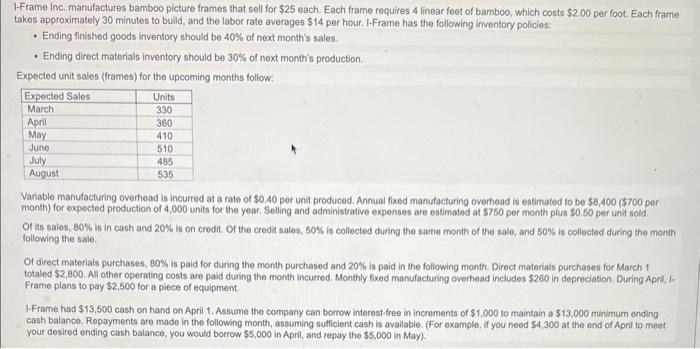

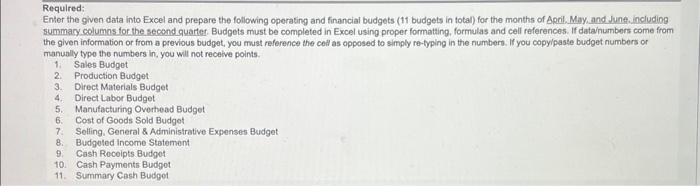

1-Frame inc. manufactures bamboo picture frames that sell for $25 each. Each frame requires 4 linear feet of bamboo, which costs $2.00 per foot. Each frame takes approximately 30 minutes to build, and the labor rate averages $14 per hour. I-Frame has the following inventory policies: - Ending finished goods inventory should be 40% of next month's sales. - Ending direct materials inventory should be 30% of next month's production. Expected unit sales (frames) for the upcoming months follow: Variable manufacturing overhead is incurred at a rate of $0,40 per unit produced. Annual fixed manufacturing overhead is 0 stimatod to be $8,400 ( $700 per month) for expected production of 4,000 units for the year. Selling and administrative expenses are estimated at $750 per month plus $0.50 per unit sold. Of its sales, 80% is in cash and 20% is on credit. Of the credi sales, 50% is collected during the same month of the sale, and 50% is collected during the month following the sale. Of direct materials purchases, 80% is paid for during the month purchased and 20% is paid in the following month Direct materials purchases for March 1 totaled $2,800. All other operating costs are paid during the month incurred. Monthly fixed manufacturing overhead includes $260 in depreciation. During April, I. Frame plans to pay $2,500 for a plece of equipment. I.Frame had $13,500 cash on hand on April 1. Assume the company can bortow intorest-free in incroments of $1,000 to maintain a $13,000 minimum ending cash balance. Repayments are made in the following month, assuming sufficient cash is available. (For oxamplo, if you need $4,300 at the end of April to moet your desired ending cash balance, you would borrow $5,000 in Aprit, and repay the $5,000 in May) Enter the given data into Excel and prepare the following operating and financial budgets (11 budgets in total) for the months of April, May, and June. includiog 5ummary columns for the second quarter. Budgets must be completed in Excel using proper formatting, formulas and cell references. If datainumbers come from the given information or from a previous budget, you must reference the cell as opposed to simply re-typing in the numbert. If you copyipaste budget numbers or manuolly typo the numbers in, you will not receive points. 1. Sales Budget 2. Production Budget 3. Direct Materials Budget 4. Direct Labor Budget 5. Manufacturing Overhead Budget 6. Cost of Goods Sold Budget 7. Selling. General \& Administrative Expenses Budget 8. Budgoted income Statement 9. Cash Rocoipts. Budgot 10. Cash Payments Budgot 11. Summary Cash Budgot 1-Frame inc. manufactures bamboo picture frames that sell for $25 each. Each frame requires 4 linear feet of bamboo, which costs $2.00 per foot. Each frame takes approximately 30 minutes to build, and the labor rate averages $14 per hour. I-Frame has the following inventory policies: - Ending finished goods inventory should be 40% of next month's sales. - Ending direct materials inventory should be 30% of next month's production. Expected unit sales (frames) for the upcoming months follow: Variable manufacturing overhead is incurred at a rate of $0,40 per unit produced. Annual fixed manufacturing overhead is 0 stimatod to be $8,400 ( $700 per month) for expected production of 4,000 units for the year. Selling and administrative expenses are estimated at $750 per month plus $0.50 per unit sold. Of its sales, 80% is in cash and 20% is on credit. Of the credi sales, 50% is collected during the same month of the sale, and 50% is collected during the month following the sale. Of direct materials purchases, 80% is paid for during the month purchased and 20% is paid in the following month Direct materials purchases for March 1 totaled $2,800. All other operating costs are paid during the month incurred. Monthly fixed manufacturing overhead includes $260 in depreciation. During April, I. Frame plans to pay $2,500 for a plece of equipment. I.Frame had $13,500 cash on hand on April 1. Assume the company can bortow intorest-free in incroments of $1,000 to maintain a $13,000 minimum ending cash balance. Repayments are made in the following month, assuming sufficient cash is available. (For oxamplo, if you need $4,300 at the end of April to moet your desired ending cash balance, you would borrow $5,000 in Aprit, and repay the $5,000 in May) Enter the given data into Excel and prepare the following operating and financial budgets (11 budgets in total) for the months of April, May, and June. includiog 5ummary columns for the second quarter. Budgets must be completed in Excel using proper formatting, formulas and cell references. If datainumbers come from the given information or from a previous budget, you must reference the cell as opposed to simply re-typing in the numbert. If you copyipaste budget numbers or manuolly typo the numbers in, you will not receive points. 1. Sales Budget 2. Production Budget 3. Direct Materials Budget 4. Direct Labor Budget 5. Manufacturing Overhead Budget 6. Cost of Goods Sold Budget 7. Selling. General \& Administrative Expenses Budget 8. Budgoted income Statement 9. Cash Rocoipts. Budgot 10. Cash Payments Budgot 11. Summary Cash Budgot

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts