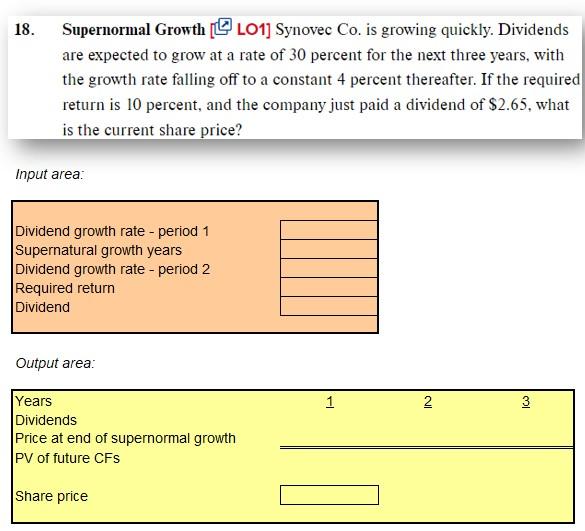

Question: Please use Excel formulas to help me understand how to solve this questions in Excel format. 18. Supernormal Growth [ LO1] Synovec Co. is growing

![this questions in Excel format. 18. Supernormal Growth [ LO1] Synovec Co.](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/09/66f9423ca8155_45266f9423c51a7d.jpg)

Please use Excel formulas to help me understand how to solve this questions in Excel format.

18. Supernormal Growth [ LO1] Synovec Co. is growing quickly. Dividends are expected to grow at a rate of 30 percent for the next three years, with the growth rate falling off to a constant 4 percent thereafter. If the requirec return is 10 percent, and the company just paid a dividend of $2.65, what is the current share price? Input area: Output area: 20. Negative Growth [ LO1] Antiques R Us is a mature manufacturing firm. The company just paid a dividend of $12.40, but management expects to reduce the payout by 4 percent per year indefinitely. If you require a return of 9.5 percent on this stock, what will you pay for a share today? Input area: Dividend paid Dividend growth rate Required return Output area

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts