Question: please use excel functions Cheet Set Capital Structure Part Recall from lecture notes and textbook Erreur ofully capital menoreturn oncept, Interest rate andet tarme with

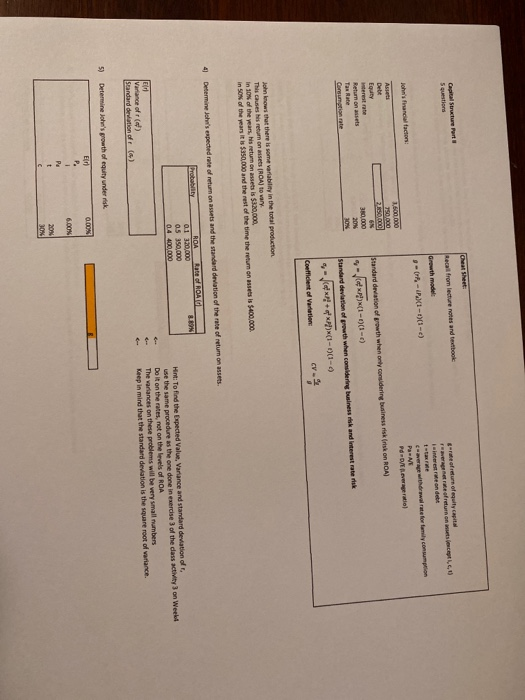

Cheet Set Capital Structure Part Recall from lecture notes and textbook Erreur ofully capital menoreturn oncept, Interest rate andet tarme with ware for family consumption PM Peverage ratio ) --X1-)(1-0) he's fraction: T600 000 750 000 2000 AN Debe Equity terest rate Return on assets Taste 30,000 Standard deviation of growth when only considering business risk risk on ROA) -(1-001-c) Standard deviation growth when considering business risk and wterest rate nak --xxx-00-0 Coefficient of Variation John Knows that there is some variability in the total production This causes his return on assets (ROA) to vary. In 10% of the years, his return on assets is $320,000 in Son of the years it is $150,000 and the rest of the time the retum an assets is $400,000 4 Determine John's expected rate of return on assets and the standard deviation of the rate of return on assets. Probability 8.89 ROA Rote ROAG 0.1 120,000 05 350,000 04 400.000 Hint: To find the expected Value, Variance and standard deviation of use the same procedure as the one done in exercise 3 of the class activity on Week Do it on the rates, not on the levels of ROA The variances on these problems will be very small numbers Keep in mind that the standard deviation is the square root of variance Ed Varance of red) Standard deviation ) 5) Determine John's growth of equity under risk GOON 6.00 P. 1 Pa t C 20N 30% Cheet Set Capital Structure Part Recall from lecture notes and textbook Erreur ofully capital menoreturn oncept, Interest rate andet tarme with ware for family consumption PM Peverage ratio ) --X1-)(1-0) he's fraction: T600 000 750 000 2000 AN Debe Equity terest rate Return on assets Taste 30,000 Standard deviation of growth when only considering business risk risk on ROA) -(1-001-c) Standard deviation growth when considering business risk and wterest rate nak --xxx-00-0 Coefficient of Variation John Knows that there is some variability in the total production This causes his return on assets (ROA) to vary. In 10% of the years, his return on assets is $320,000 in Son of the years it is $150,000 and the rest of the time the retum an assets is $400,000 4 Determine John's expected rate of return on assets and the standard deviation of the rate of return on assets. Probability 8.89 ROA Rote ROAG 0.1 120,000 05 350,000 04 400.000 Hint: To find the expected Value, Variance and standard deviation of use the same procedure as the one done in exercise 3 of the class activity on Week Do it on the rates, not on the levels of ROA The variances on these problems will be very small numbers Keep in mind that the standard deviation is the square root of variance Ed Varance of red) Standard deviation ) 5) Determine John's growth of equity under risk GOON 6.00 P. 1 Pa t C 20N 30%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts