Question: Please use excel functions in answer, fill out the table that is at the bottom. Thank You! Esfandairi Enterprises is considering a new three-year expansian

Please use excel functions in answer, fill out the table that is at the bottom. Thank You!

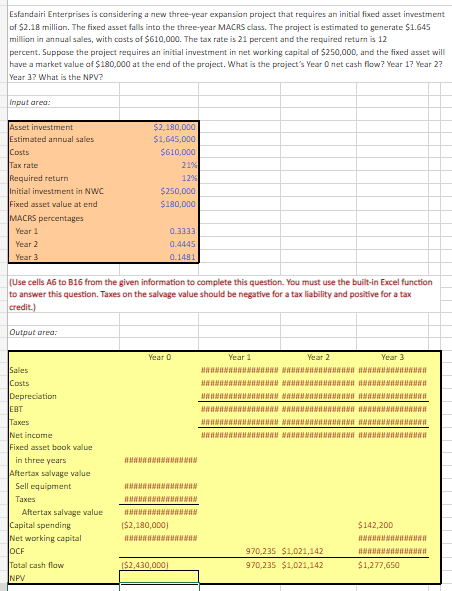

Esfandairi Enterprises is considering a new three-year expansian project that requires an initial fixed asset investrnent of $2.18 million. The fixed asset falls into the three-vear MACRS class. The project is estimated to generate $1.645 million in annual sales, with costs of $610,000. The tax rate is 21 percent and the required retum is 12 percent. Suppose the project requires an initial irrvestment in net working capital of $250,000, and the fixed asset will have a market value of $180,000 at the end of the project. What is the project's Year 0 net cash flow? Year 1 ? Year 2 ? Year 3? What is the NPV? (Use cells A. to B16 from the given information to complete this question. You must use the built-in Excel function to answer this question. Taxes on the salvage value should be negative for a tax liability and positive for a tax

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts