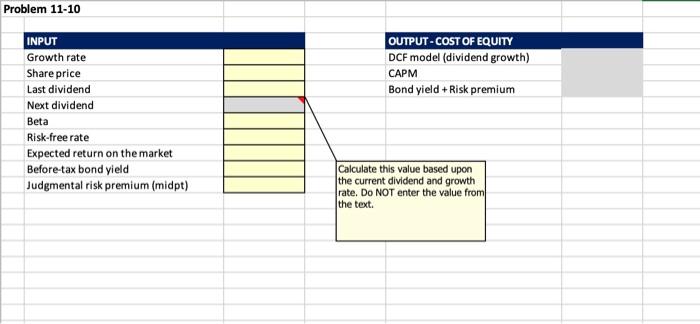

Question: **Please use excel info as a templete and shows the formulas** Problem 11-10 OUTPUT-COST OF EQUITY DCF model (dividend growth) CAPM Bond yield + Risk

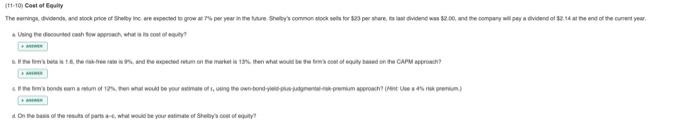

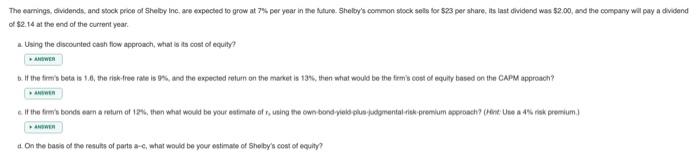

Problem 11-10 OUTPUT-COST OF EQUITY DCF model (dividend growth) CAPM Bond yield + Risk premium INPUT Growth rate Share price Last dividend Next dividend Beta Risk-free rate Expected return on the market Before tax bond yield Judgmental risk premium (midpt) Calculate this value based upon the current dividend and growth rate. Do NOT enter the value from the text. it to cost of Equity The warning, Odendo, we stock prior of Shelby incorrected to grow as per year in the Bare Shots common stock potter 823 per share to us dend w 32.00 und the company wil beyan dividend of 2.4 at the end of the content yw thanded on the market. Then what would be cool could on the CAPM? cond common that out to your time of the own tende a punt rowent were De bedstefore, what would be your neer Shebay.com/ The earrings, Gvidends, and stock price of Sheby Inc. are expected to grow at 7% per year in the tuture. Shelby's common stock seis toe 523 per share, Is tut duidend was $2.00, and the company will pay a dividend of $2.14 at the end of the current year. 1. Using the discounted cash flow approach, what is a cost of equity? AMER with the firm's betals 1.6, the risk free rate is 19%, and the expected return on the market is 13%, an what would be the tem's cost of equity trased on the CAPM approach? c. It he towe bonds earn a rotum of 12%, then what would be your satimato at v, uning the own bond yield plus atpmental risk premium approach? (Pene: Use 4 rok premium) 4. On the basis of the resuts of parts a-c, what would be your estimate of Sholby's cost of equity

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts