Question: PLEASE USE EXCEL LP SOLVER 3. A portfolio manager must determine how to allocate the portfolio's funds. There are five investments under consideration, bonds, mutual

PLEASE USE EXCEL LP SOLVER

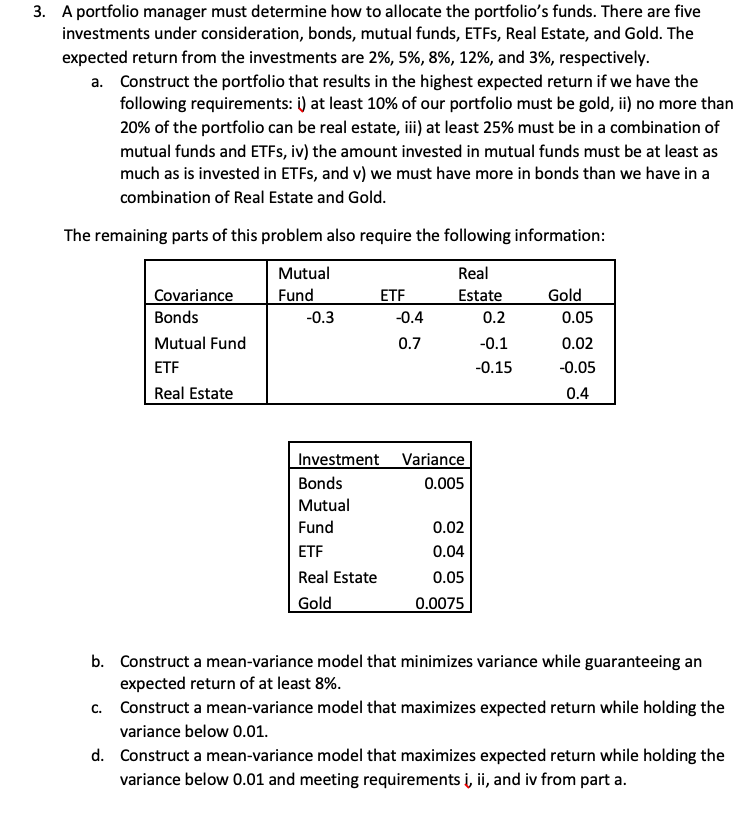

3. A portfolio manager must determine how to allocate the portfolio's funds. There are five investments under consideration, bonds, mutual funds, ETFs, Real Estate, and Gold. The expected return from the investments are 2%, 5%, 8%, 12%, and 3%, respectively. a. Construct the portfolio that results in the highest expected return if we have the following requirements: i) at least 10% of our portfolio must be gold, ii) no more than 20% of the portfolio can be real estate, iii) at least 25% must be in a combination of mutual funds and ETFs, iv) the amount invested in mutual funds must be at least as much as is invested in ETFs, and v) we must have more in bonds than we have in a combination of Real Estate and Gold. The remaining parts of this problem also require the following information: Mutual Fund -0.3 ETF -0.4 Covariance Bonds Mutual Fund ETF Real Estate Real Estate 0.2 -0.1 -0.15 0.7 Gold 0.05 0.02 -0.05 0.4 Investment Variance Bonds 0.005 Mutual Fund 0.02 ETF 0.04 Real Estate 0.05 Gold 0.0075 b. Construct a mean-variance model that minimizes variance while guaranteeing an expected return of at least 8%. C. Construct a mean-variance model that maximizes expected return while holding the variance below 0.01. d. Construct a mean-variance model that maximizes expected return while holding the variance below 0.01 and meeting requirements i, ii, and is from part aStep by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock