Question: please use excel or go step by step 2. Answer the following questions given the information in the table below. Return on Stock A Annual

please use excel or go step by step

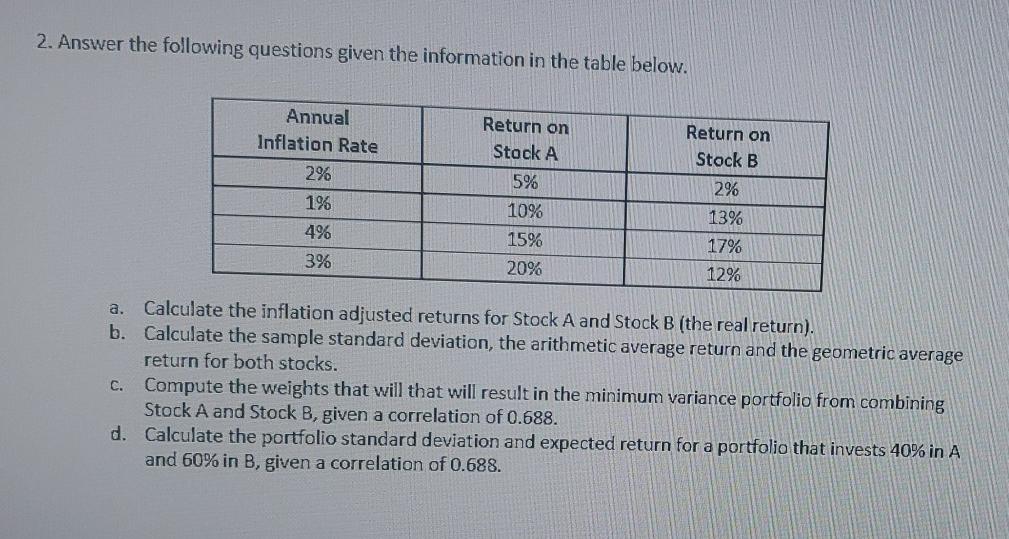

2. Answer the following questions given the information in the table below. Return on Stock A Annual Inflation Rate 2% 1% 4% 3% 5% 10% 15% Return on Stock B 2% 13% 17% 12% 20% a. Calculate the inflation adjusted returns for Stock A and Stock B (the real return). b. Calculate the sample standard deviation, the arithmetic average return and the geometric average return for both stocks. C. Compute the weights that will that will result in the minimum variance portfolio from combining Stock A and Stock B, given a correlation of 0.688. d. Calculate the portfolio standard deviation and expected return for a portfolio that invests 40% in A and 60% in B, given a correlation of 0.688

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts