Question: PLEASE USE EXCEL! Part 2 Find the future value of an increasing annuity. Imagine you want to accumulate certain amount, or future value, by making

PLEASE USE EXCEL!

Part

Find the future value of an increasing annuity.

Imagine you want to accumulate certain amount, or future value, by making the same payments for

certain number of periods. How much should your payments be

Strategy for solution:

To develop the general formula let's first figure out the future value of payments of $

The future value of the last payment made at time is just $

The future value of the next to last payment made at time is just $ the accumulated value

of a payment of $ over one period.

The future value of the payment made at time is $ the accumulated value of a payment

of $ over periods.

The future value of the payment made at time is $ the accumulated value of a payment of

$ over periods.

The future value of all payments is the sum

cdots

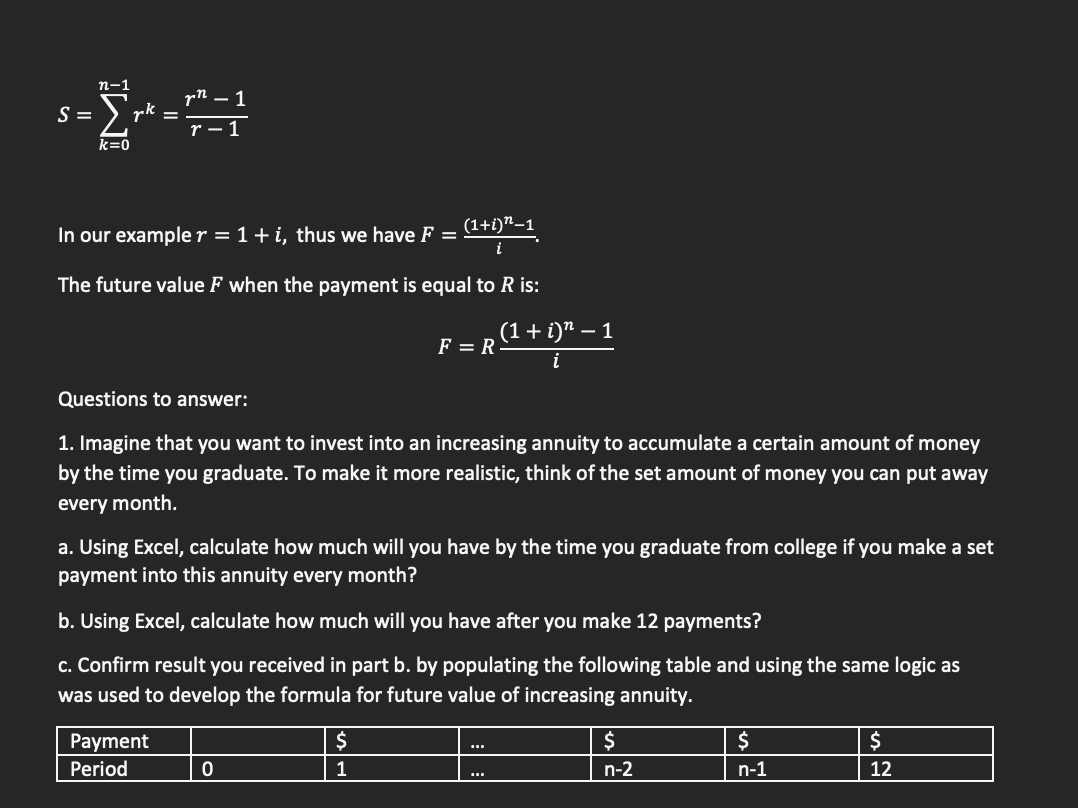

In order to find a general formula for this sum, we need to review the sum of geometric progression.

A geometric series is always going to look like

cdots for some number

Now, what does this have to do with finance? Let's look at an example.

Let cdots

cdots

cdots

The difference is:

In our example thus we have

The future value when the payment is equal to is:

Questions to answer:

Imagine that you want to invest into an increasing annuity to accumulate a certain amount of money

by the time you graduate. To make it more realistic, think of the set amount of money you can put away

every month.

a Using Excel, calculate how much will you have by the time you graduate from college if you make a set

payment into this annuity every month?

b Using Excel, calculate how much will you have after you make payments?

c Confirm result you received in part b by populating the following table and using the same logic as

was used to develop the formula for future value of increasing annuity.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock