Question: please use excel sheets already made to answer the following :) Using all of your original forecasts, what would the net present value (NW) of

please use excel sheets already made to answer the following :)

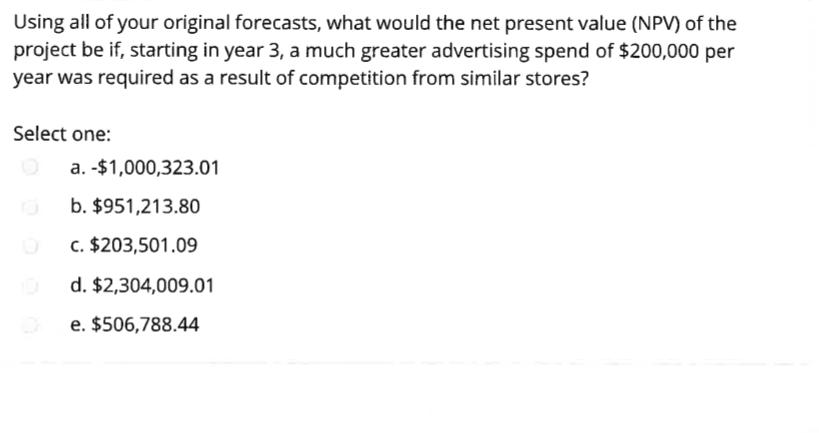

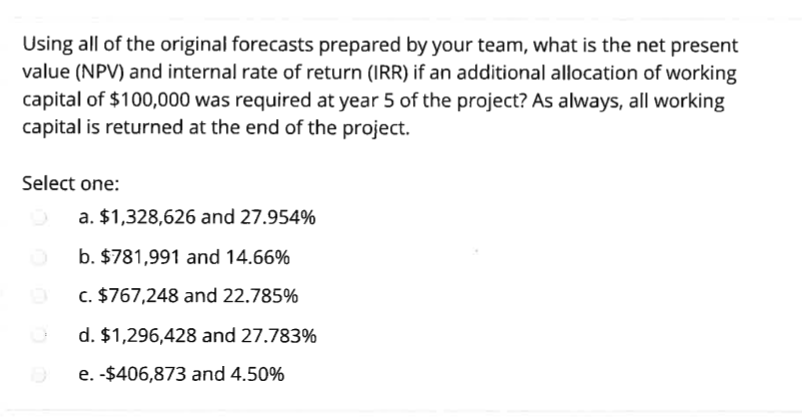

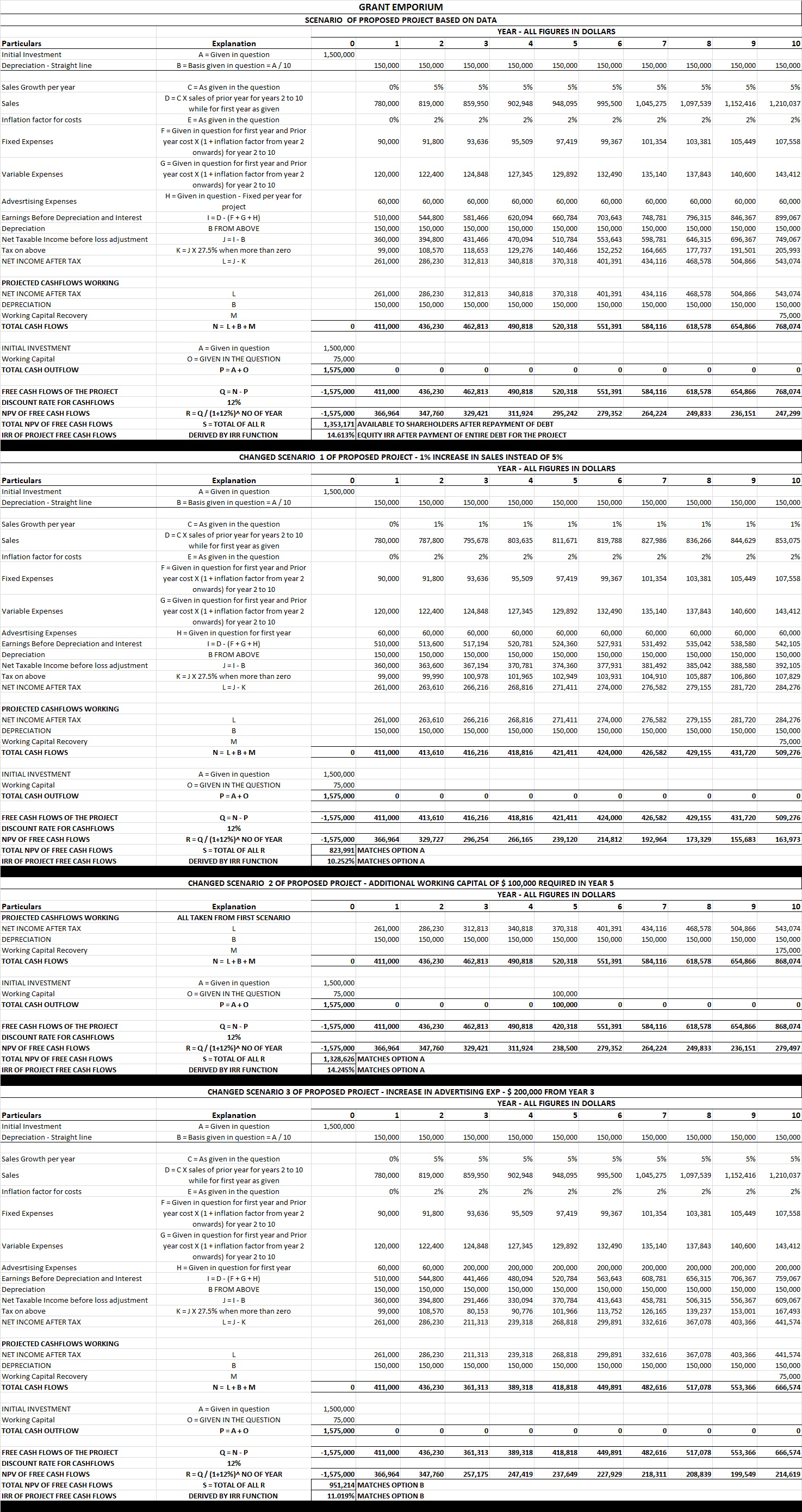

Using all of your original forecasts, what would the net present value (NW) of the project be if, starting in year 3, a much greater advertising spend of $200,000 per year was required as a result of competition from similar stores? Select one: a. -$1,000,323.01 b. $951,213.80 c. $203,501.09 d. $2,304,009.01 e. $506,788.44 Using all of the original forecasts prepared by your team, what is the net present value (NW) and internal rate of return (IRR) if an additional allocation of working capital of $1 00,000 was required at year 5 of the project? As always, all working capital is returned at the end of the project. Select one: a. $1,328,626 and 27.95495 b. 981,991 and 14.66% c. $761248 and 22.789": d. $1,295,428 and 2?,?83% e. -$406,8?3 and 4.50% YEAR - ALL FIGURES IN DOLLARS 1,500,000 150,000 150,000 150,000 150,000 150,000 150,000 150,000 150,000 150,000 150,00 D = CX sales of prior year for years 2 to 10 819,000 $59,950 902,948 95,500 1,045,275 1,152,416 29 29% 29% F = Given in question for first year and Prior 90,00 91,800 93,636 95,50 97,419 9,367 103,381 105,449 107,55 onwards) for year 2 to 10 120,000 122,400 124,848 127,345 129,892 132,490 135,140 137,843 140,600 143,41 onwards) for year 2 to 10 620,094 FROM ABOVE 150,000 50,000 150,000 150,00 150,000 150,000 360,000 470,094 749 ,067 99,000 118,653 140,466 152,252 191,501 205,993 340,818 370,318 401,391 543 , 074 NET INCOME AFTER TAX PROJECTED CASHFLOWS WORKING 286,230 312,813 370,318 401,391 434,116 504,866 150,000 150,000 150,000 150,000 150,000 150,000 150,000 75,00 436,230 462,813 490,818 551,391 584,116 654,86 D = GIVEN IN THE QUESTION P=A+0 2 = N- P R = Q/ (1+12%)^ NO OF YEAR 249,833 236,151 247,29 NPV OF FREE CASH FLOWS S = TOTAL OF ALL R 1,353,171 AVAILABLE TO SHAREHOLDERS AFTER REPAYMENT OF DEBT DERIVED BY IRR FUNCTION YEAR - ALL FIGURES IN DOLLARS Explanation A = Given in question 150,000 50,000 150,000 150,000 150,000 150,00 150,000 150,00 D = CX sales of prior year for years 2 to 10 780,000 827,986 853,07 29 F = Given in question for first year and Prior 90,00 91,800 93,636 95,50 97,419 9,367 onwards) for year 2 to 10 120,000 122,400 127,345 129,892 137,843 143,41 onwards) for year 2 to 10 60,00 60,000 60,00 60,000 60,00 50,00 60,000 60,00 513,600 531,492 535,042 63,600 370,781 374,360 385,042 392,105 K = J X 27.5% when more than zero 99,000 99,990 105,887 263,610 284,276 263,610 266,216 271,411 274,000 279,155 281,720 284,27 150,000 150,000 150,000 75,000 509,276 TOTAL CASH FLOWS 1,500,000 TOTAL CASH OUTFLOW Q =N-P 413,610 426,582 429,155 DISCOUNT RATE FOR CASHFLOWS 12% 296,254 214,812 192,964 173,329 TOTAL NPV OF FREE CASH FLOWS S = TOTAL OF ALL R IRR OF PROJECT FREE CASH FLOWS DERIVED BY IRR FUNCTION 10.252% MATCHES OPTION A CHANGED SCENARIO 2 OF PROPOSED PROJECT - ADDITIONAL WORKING CAPITAL OF $ 100,000 REQUIRED IN YEAR 5 YEAR - ALL FIGURES IN DOLLARS Particulars PROJECTED CASHFLOWS WORKING ALL TAKEN FROM FIRST SCENARIO 40,818 401,391 504,866 543,07 150,000 150,000 150,000 150,000 436,230 490,818 868,07 A = Given in question 75,000 100,000 2= N -P -1,575,000 411,000 436,230 420,318 618,578 R =Q/ (1+12%)^ NO OF YEAR -1,575,000 TOTAL NPV OF FREE CASH FLOW S = TOTAL OF ALL R 1,328,626 MATCHES OPTION A DERIVED BY IRR FUNCTION 14.245% MATCHES OPTION A CHANGED SCENARIO 3 OF PROPOSED PROJECT - INCREASE IN ADVERTISING EXP - $ 200,000 FROM YEAR 3 YEAR - ALL FIGURES IN DOLLARS A = Given in question 1,500,000 Sales Growth per year 819,000 859,950 948,095 995,500 1,045,275 1,097,539 1,152,416 while for first year as giver F = Given in question for first year and Prior 90,000 91,800 93,636 95,509 97.419 39.367 101,354 105,44 122,400 24,848 129,892 132,490 137,843 40,600 143 ,41 onwards) for year 2 to 10 544,800 141,466 520,784 608,781 56,315 706,367 FROM ABOVE 150,000 150,000 394,800 413,643 458,781 556,367 K =J X 27.5% when more than zero 99,000 80,153 90,776 101,966 113,752 139,237 153,001 367,078 PROJECTED CASHFLOWS WORKING 261,000 211,313 239,318 299,891 332,616 403,366 441,57 150,000 150,000 150,000 150,000 DEPRECIATION 150,000 150,000 150,00 TOTAL CASH FLOWS N = L+B+M 436,230 418,818 517,078 D = GIVEN IN THE QUESTION P=A+0 1,575,000 361,313 389,318 553,366 DISCOUNT RATE FOR CASHFLOWS 12% NPV OF FREE CASH FLOWS R=Q/ (1+12%)^ NO OF YEAR 257,175 218,311 IRR OF PROJECT FREE CASH FLOWS DERIVED BY IRR FUNCTION