Question: please use excel & show the formula :) Download Print Save to OneDrive Date Assigned: Wednesday, June 17, 2020 Date Due: Thursday, June 18, 2020

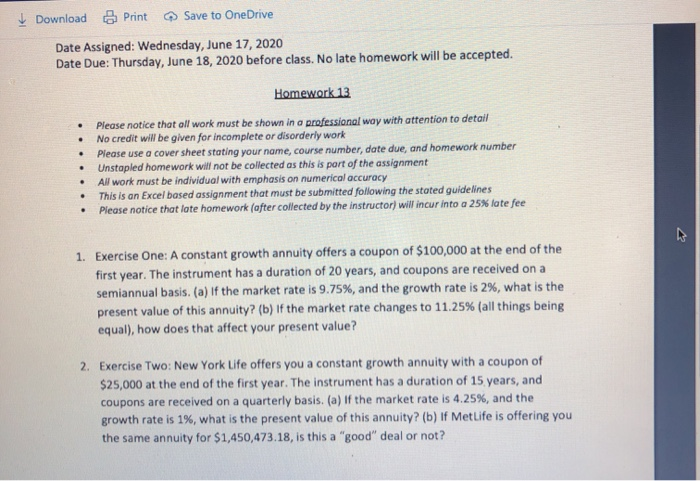

Download Print Save to OneDrive Date Assigned: Wednesday, June 17, 2020 Date Due: Thursday, June 18, 2020 before class. No late homework will be accepted. Homework 13 . . . Please notice that all work must be shown in a professional way with attention to detail No credit will be given for incomplete or disorderly work Please use a cover sheet stating your name, course number, date due, and homework number Unstapled homework will not be collected as this is part of the assignment All work must be individual with emphasis on numerical accuracy This is an Excel based assignment that must be submitted following the stated guidelines Please notice that lote homework (after collected by the instructor) will incur into a 25% fate fee . . . 1. Exercise One: A constant growth annuity offers a coupon of $100,000 at the end of the first year. The instrument has a duration of 20 years, and coupons are received on a semiannual basis. (a) If the market rate is 9.75%, and the growth rate is 2%, what is the present value of this annuity? (b) If the market rate changes to 11.25% (all things being equal), how does that affect your present value? 2. Exercise Two: New York Life offers you a constant growth annuity with a coupon of $25,000 at the end of the first year. The instrument has a duration of 15 years, and coupons are received on a quarterly basis. (a) If the market rate is 4.25%, and the growth rate is 1%, what is the present value of this annuity? (b) If MetLife is offering you the same annuity for $1,450,473.18, is this a "good" deal or not? Download Print Save to OneDrive Date Assigned: Wednesday, June 17, 2020 Date Due: Thursday, June 18, 2020 before class. No late homework will be accepted. Homework 13 . . . Please notice that all work must be shown in a professional way with attention to detail No credit will be given for incomplete or disorderly work Please use a cover sheet stating your name, course number, date due, and homework number Unstapled homework will not be collected as this is part of the assignment All work must be individual with emphasis on numerical accuracy This is an Excel based assignment that must be submitted following the stated guidelines Please notice that lote homework (after collected by the instructor) will incur into a 25% fate fee . . . 1. Exercise One: A constant growth annuity offers a coupon of $100,000 at the end of the first year. The instrument has a duration of 20 years, and coupons are received on a semiannual basis. (a) If the market rate is 9.75%, and the growth rate is 2%, what is the present value of this annuity? (b) If the market rate changes to 11.25% (all things being equal), how does that affect your present value? 2. Exercise Two: New York Life offers you a constant growth annuity with a coupon of $25,000 at the end of the first year. The instrument has a duration of 15 years, and coupons are received on a quarterly basis. (a) If the market rate is 4.25%, and the growth rate is 1%, what is the present value of this annuity? (b) If MetLife is offering you the same annuity for $1,450,473.18, is this a "good" deal or not

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts