Question: Please USE EXCEL SOLVER TO SOLVE THIS QUESTION: The city council of Aberdeen must determine the tax policy for the city for the coming year.

Please USE EXCEL SOLVER TO SOLVE THIS QUESTION:

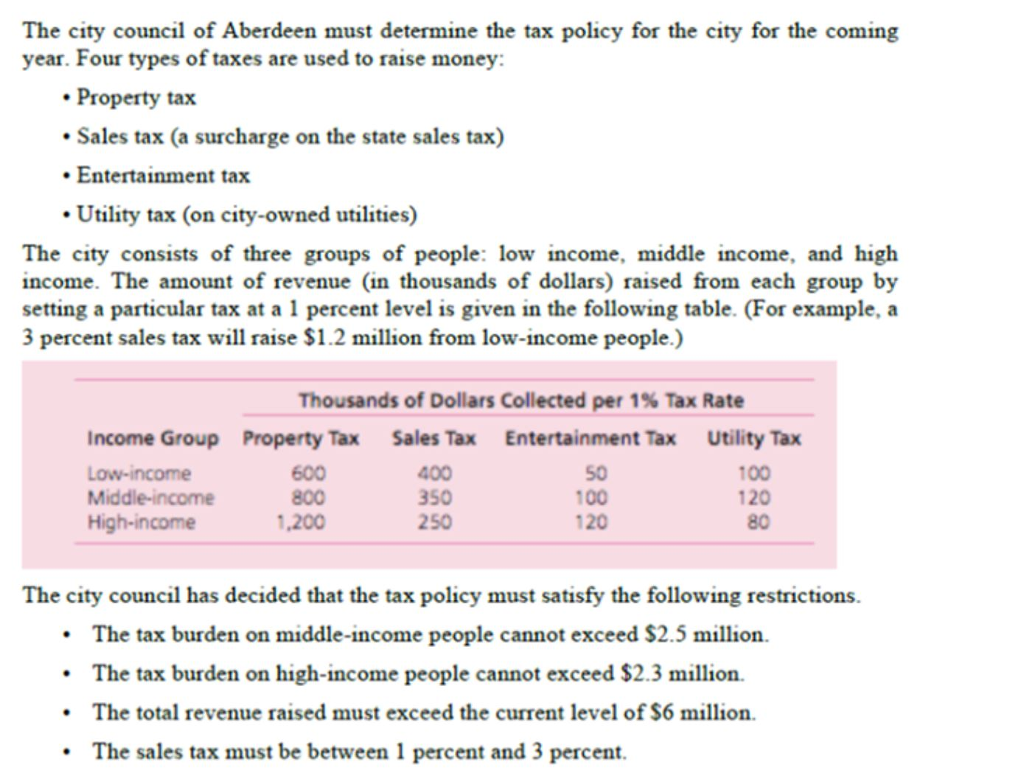

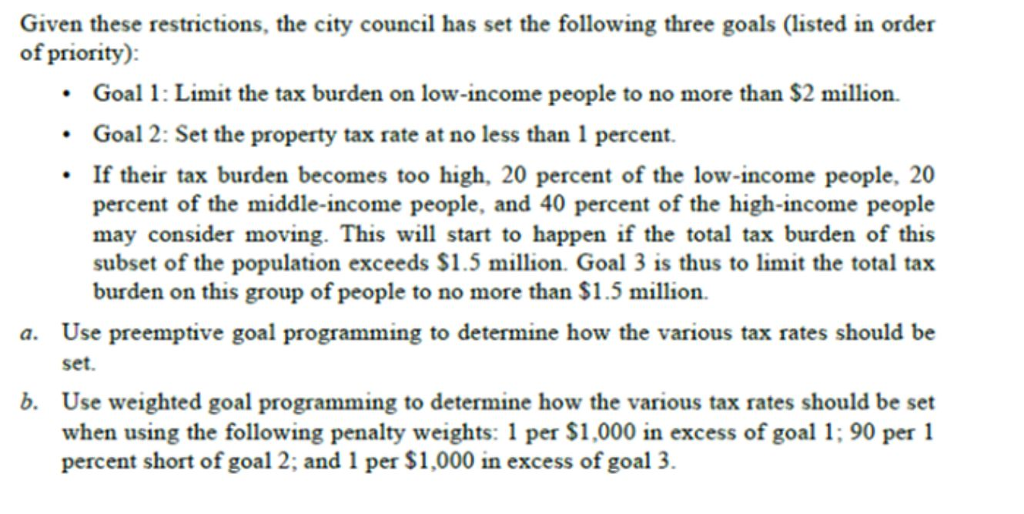

The city council of Aberdeen must determine the tax policy for the city for the coming year. Four types of taxes are used to raise money: Property tax Sales tax (a surcharge on the state sales tax) . Entertainment tax Utility tax (on city-owned utliies) The city consists of three groups of people: low income, middle income, and high income. The amount of revenue (in thousands of dollars) raised from each group by setting a particular tax at a 1 percent level is given in the following table. (For example, a 3 percent sales tax will raise $1.2 million from low-income people.) Thousands of Dollars Collected per 1% Tax Rate Income Group Property Tax 600 800 1,200 Sales Tax 400 350 250 Entertainment Tax 50 100 120 Utility Tax 100 120 80 Middle-income High-income The city council has decided that the tax policy must satisfy the following restrictions The tax burden on middle-income people cannot exceed $2.5 million .The tax burden on high-income people cannot exceed $2.3 million .The total revenue raised must exceed the current level of $6 million The sales tax must be between 1 percent and 3 percent. The city council of Aberdeen must determine the tax policy for the city for the coming year. Four types of taxes are used to raise money: Property tax Sales tax (a surcharge on the state sales tax) . Entertainment tax Utility tax (on city-owned utliies) The city consists of three groups of people: low income, middle income, and high income. The amount of revenue (in thousands of dollars) raised from each group by setting a particular tax at a 1 percent level is given in the following table. (For example, a 3 percent sales tax will raise $1.2 million from low-income people.) Thousands of Dollars Collected per 1% Tax Rate Income Group Property Tax 600 800 1,200 Sales Tax 400 350 250 Entertainment Tax 50 100 120 Utility Tax 100 120 80 Middle-income High-income The city council has decided that the tax policy must satisfy the following restrictions The tax burden on middle-income people cannot exceed $2.5 million .The tax burden on high-income people cannot exceed $2.3 million .The total revenue raised must exceed the current level of $6 million The sales tax must be between 1 percent and 3 percent

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts