Question: Please use excel to answer A and B Risk-adjusted discount rates - Basic. Country Crooners is considering investing in one of two mutually exclusive projects,

Please use excel to answer A and B

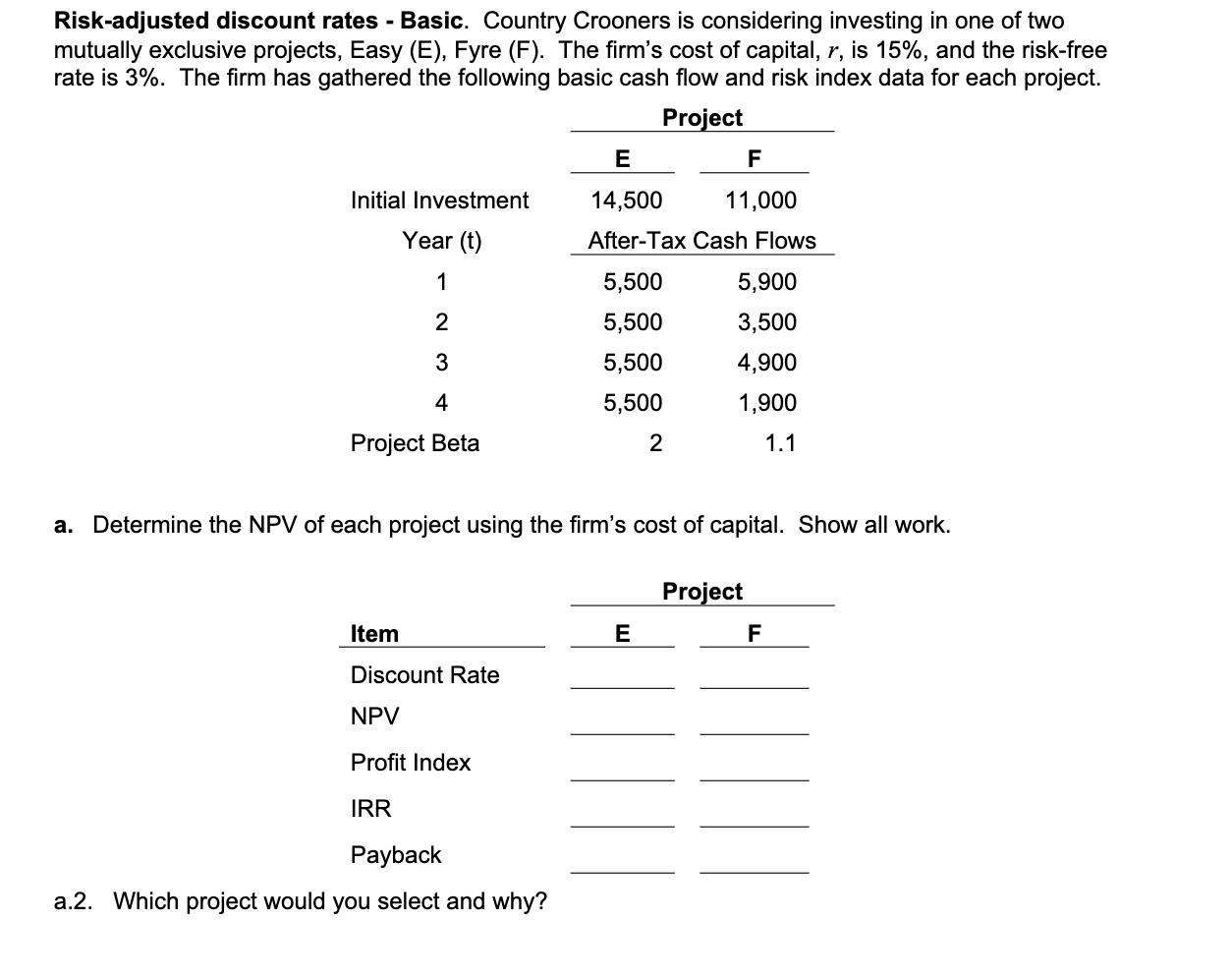

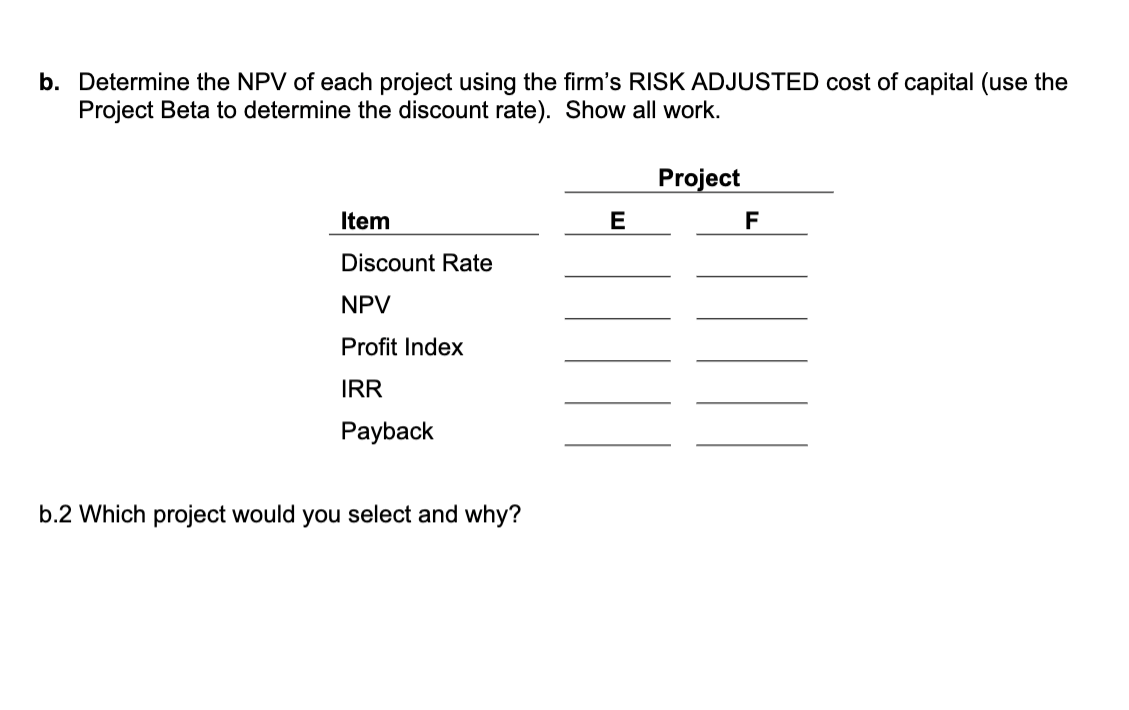

Risk-adjusted discount rates - Basic. Country Crooners is considering investing in one of two mutually exclusive projects, Easy (E), Fyre (F). The firm's cost of capital, r, is 15%, and the risk-free rate is 3%. The firm has gathered the following basic cash flow and risk index data for each project. a. Determine the NPV of each project using the firm's cost of capital. Show all work. a.2. Which project would you select and why? b. Determine the NPV of each project using the firm's RISK ADJUSTED cost of capital (use the Project Beta to determine the discount rate). Show all work. b.2 Which project would you select and why? Risk-adjusted discount rates - Basic. Country Crooners is considering investing in one of two mutually exclusive projects, Easy (E), Fyre (F). The firm's cost of capital, r, is 15%, and the risk-free rate is 3%. The firm has gathered the following basic cash flow and risk index data for each project. a. Determine the NPV of each project using the firm's cost of capital. Show all work. a.2. Which project would you select and why? b. Determine the NPV of each project using the firm's RISK ADJUSTED cost of capital (use the Project Beta to determine the discount rate). Show all work. b.2 Which project would you select and why

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts