Question: please use excel to answer QUESTION 43 Discount factor tables for the PV of 5 and PV of an annuity have been provided above. ETP

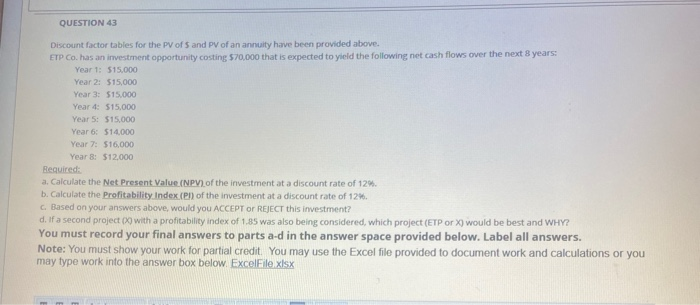

QUESTION 43 Discount factor tables for the PV of 5 and PV of an annuity have been provided above. ETP Co. has an investment opportunity costing 570,000 that is expected to yield the following net cash flows over the next 8 years: Year 1: 515.000 Year 2: $15,000 Year 3: 515.000 Year 4: $15,000 Year 5: $15,000 Year 6: $14.000 Year 7: $16,000 Year 8: $12.000 Required: a. Calculate the Net Present Value (NPV) of the investment at a discount rate of 12% b. Calculate the profitability Index (en) of the investment at a discount rate of 12%. C. Based on your answers above, would you ACCEPT OF REJECT this investment? d. If a second project with a profitability index of 1.85 was also being considered, which project (ETP or X) would be best and WHY? You must record your final answers to parts a-d in the answer space provided below. Label all answers. Note: You must show your work for partial credit. You may use the Excel file provided to document work and calculations or you may type work into the answer box below. ExcelFile.xlsx

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts