Question: please use Excel to answer Question 7: Capital Budgeting I, II & Cost of Capital Monash Logistics Trust has bonds trading at a 6% premium-tepar-value

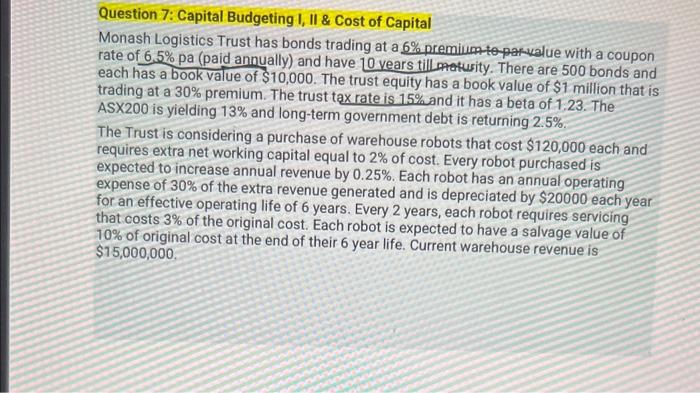

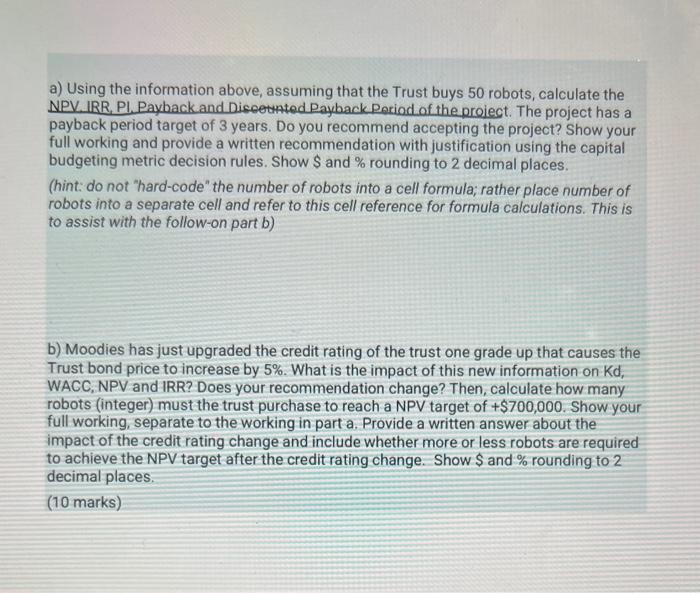

Question 7: Capital Budgeting I, II \& Cost of Capital Monash Logistics Trust has bonds trading at a 6% premium-tepar-value with a coupon rate of 6.5% pa (paid annually) and have 10 vears till mpaturity. There are 500 bonds and each has a book value of $10,000. The trust equity has a book value of $1 million that is trading at a 30% premium. The trust tax rate is 15% and it has a beta of 1,23 . The ASX200 is yielding 13% and long-term government debt is returning 2.5%. The Trust is considering a purchase of warehouse robots that cost $120,000 each and requires extra net working capital equal to 2% of cost. Every robot purchased is expected to increase annual revenue by 0.25%. Each robot has an annual operating expense of 30% of the extra revenue generated and is depreciated by $20000 each year for an effective operating life of 6 years. Every 2 years, each robot requires servicing that costs 3% of the original cost. Each robot is expected to have a salvage value of 10% of original cost at the end of their 6 year life. Current warehouse revenue is $15,000,000, a) Using the information above, assuming that the Trust buys 50 robots, calculate the NPV. IRR, Pl, Payback and Diseetnted Payback Poriod of the project. The project has a payback period target of 3 years. Do you recommend accepting the project? Show your full working and provide a written recommendation with justification using the capital budgeting metric decision rules. Show $ and % rounding to 2 decimal places. (hint: do not "hard-code" the number of robots into a cell formula; rather place number of robots into a separate cell and refer to this cell reference for formula calculations. This is to assist with the follow-on part b) b) Moodies has just upgraded the credit rating of the trust one grade up that causes the Trust bond price to increase by 5%. What is the impact of this new information on Kd, WACC, NPV and IRR? Does your recommendation change? Then, calculate how many robots (integer) must the trust purchase to reach a NPV target of +$700,000. Show your full working, separate to the working in part a. Provide a written answer about the impact of the credit rating change and include whether more or less robots are required to achieve the NPV target after the credit rating change. Show $ and % rounding to 2 decimal places. (10 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts