Question: **please use excel to show calculations** **please do not copy and paste the same answer that has been posted for this question** Assume you bought

**please use excel to show calculations**

**please do not copy and paste the same answer that has been posted for this question**

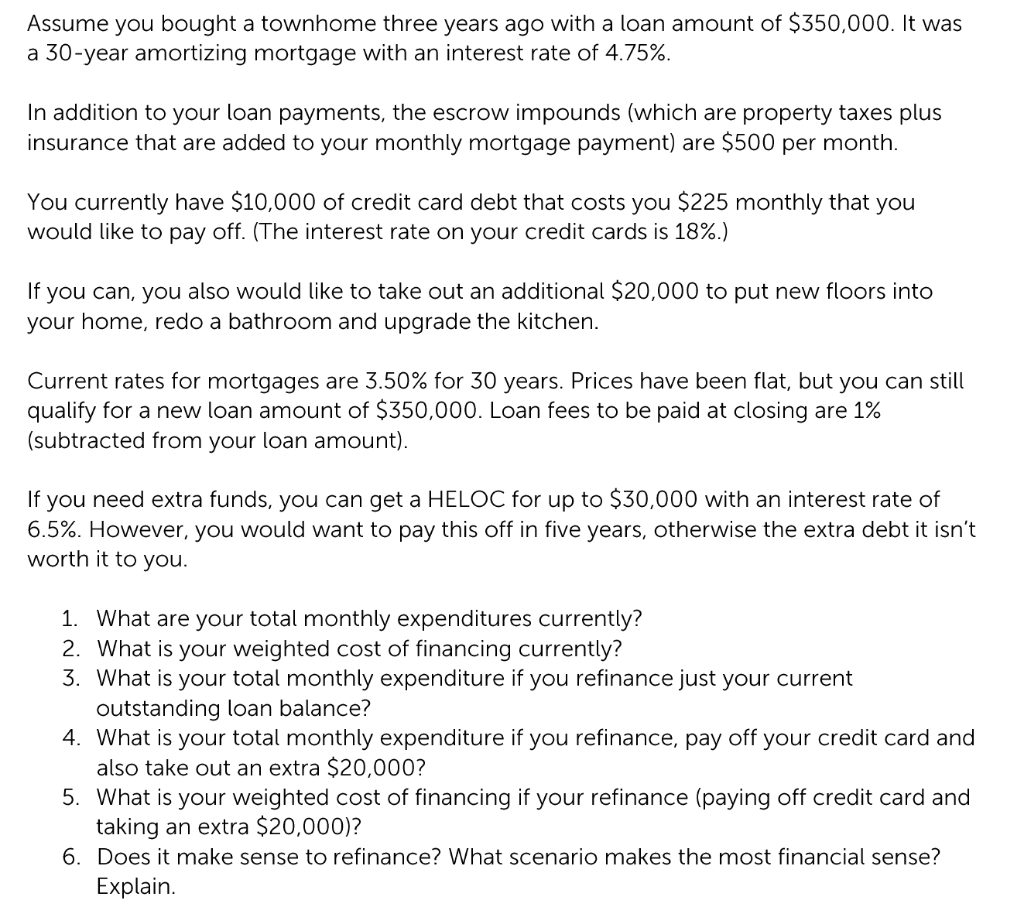

Assume you bought a townhome three years ago with a loan amount of $350,000. It was a 30-year amortizing mortgage with an interest rate of 4.75%. In addition to your loan payments, the escrow impounds (which are property taxes plus insurance that are added to your monthly mortgage payment) are $500 per month. You currently have $10,000 of credit card debt that costs you $225 monthly that you would like to pay off. (The interest rate on your credit cards is 18%.) If you can, you also would like to take out an additional $20,000 to put new floors into your home, redo a bathroom and upgrade the kitchen. Current rates for mortgages are 3.50% for 30 years. Prices have been flat, but you can still qualify for a new loan amount of $350,000. Loan fees to be paid at closing are 1% (subtracted from your loan amount). If you need extra funds, you can get a HELOC for up to $30,000 with an interest rate of 6.5%. However, you would want to pay this off in five years, otherwise the extra debt it isn't worth it to you. 1. What are your total monthly expenditures currently? 2. What is your weighted cost of financing currently? 3. What is your total monthly expenditure if you refinance just your current outstanding loan balance? 4. What is your total monthly expenditure if you refinance, pay off your credit card and also take out an extra $20,000? 5. What is your weighted cost of financing if your refinance (paying off credit card and taking an extra $20,000)? 6. Does it make sense to refinance? What scenario makes the most financial sense? Explain. Assume you bought a townhome three years ago with a loan amount of $350,000. It was a 30-year amortizing mortgage with an interest rate of 4.75%. In addition to your loan payments, the escrow impounds (which are property taxes plus insurance that are added to your monthly mortgage payment) are $500 per month. You currently have $10,000 of credit card debt that costs you $225 monthly that you would like to pay off. (The interest rate on your credit cards is 18%.) If you can, you also would like to take out an additional $20,000 to put new floors into your home, redo a bathroom and upgrade the kitchen. Current rates for mortgages are 3.50% for 30 years. Prices have been flat, but you can still qualify for a new loan amount of $350,000. Loan fees to be paid at closing are 1% (subtracted from your loan amount). If you need extra funds, you can get a HELOC for up to $30,000 with an interest rate of 6.5%. However, you would want to pay this off in five years, otherwise the extra debt it isn't worth it to you. 1. What are your total monthly expenditures currently? 2. What is your weighted cost of financing currently? 3. What is your total monthly expenditure if you refinance just your current outstanding loan balance? 4. What is your total monthly expenditure if you refinance, pay off your credit card and also take out an extra $20,000? 5. What is your weighted cost of financing if your refinance (paying off credit card and taking an extra $20,000)? 6. Does it make sense to refinance? What scenario makes the most financial sense? Explain

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts