Question: Please use excel to solve and show all steps. 2. A particular call is the option to buy stock at $25. It expires in six

Please use excel to solve and show all steps.

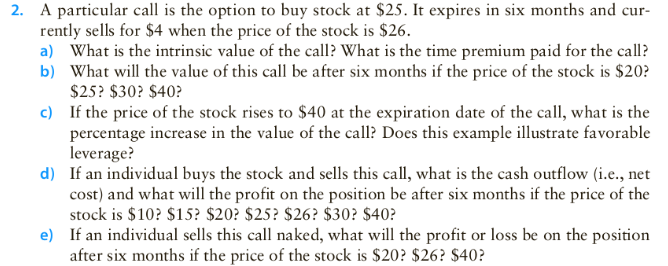

2. A particular call is the option to buy stock at $25. It expires in six months and cur- rently sells for $4 when the price of the stock is $26. a) What is the intrinsic value of the call? What is the time premium paid for the call? b) What will the value of this call be after six months if the price of the stock is $20? $25? $30? $40? c) If the price of the stock rises to $40 at the expiration date of the call, what is the percentage increase in the value of the call? Does this example illustrate favorable leverage? d) If an individual buys the stock and sells this call, what is the cash outflow (i.e., net cost) and what will the profit on the position be after six months if the price of the stock is $10? $15? $20? $25? $26? $30? $40? e) If an individual sells this call naked, what will the profit or loss be on the position after six months if the price of the stock is $20? $26? $40

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts