Question: Please use excel to solve and show all steps. 5. An American portfolio manager owns a bond worth 2,000,000 that will mature in one year.

Please use excel to solve and show all steps.

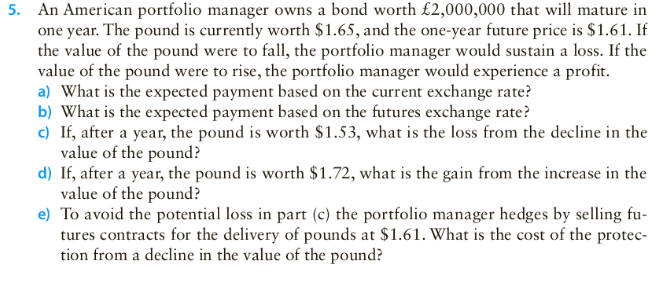

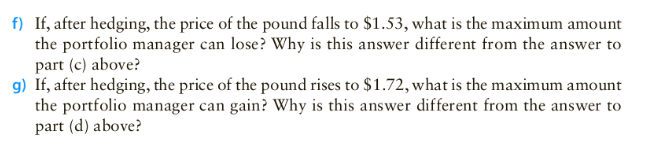

5. An American portfolio manager owns a bond worth 2,000,000 that will mature in one year. The pound is currently worth $1.65, and the one-year future price is $1.61. If the value of the pound were to fall, the portfolio manager would sustain a loss. If the value of the pound were to rise, the portfolio manager would experience a profit. a) What is the expected payment based on the current exchange rate? b) What is the expected payment based on the futures exchange rate? c) If, after a year, the pound is worth $1.53, what is the loss from the decline in the value of the pound? d) If, after a year, the pound is worth $1.72, what is the gain from the increase in the value of the pound? e) To avoid the potential loss in part (c) the portfolio manager hedges by selling fu- tures contracts for the delivery of pounds at $1.61. What is the cost of the protec- tion from a decline in the value of the pound? f) If, after hedging, the price of the pound falls to $1.53, what is the maximum amount the portfolio manager can lose? Why is this answer different from the answer to part (c) above? g) If, after hedging, the price of the pound rises to $1.72, what is the maximum amount the portfolio manager can gain? Why is this answer different from the answer to part (d) above? 5. An American portfolio manager owns a bond worth 2,000,000 that will mature in one year. The pound is currently worth $1.65, and the one-year future price is $1.61. If the value of the pound were to fall, the portfolio manager would sustain a loss. If the value of the pound were to rise, the portfolio manager would experience a profit. a) What is the expected payment based on the current exchange rate? b) What is the expected payment based on the futures exchange rate? c) If, after a year, the pound is worth $1.53, what is the loss from the decline in the value of the pound? d) If, after a year, the pound is worth $1.72, what is the gain from the increase in the value of the pound? e) To avoid the potential loss in part (c) the portfolio manager hedges by selling fu- tures contracts for the delivery of pounds at $1.61. What is the cost of the protec- tion from a decline in the value of the pound? f) If, after hedging, the price of the pound falls to $1.53, what is the maximum amount the portfolio manager can lose? Why is this answer different from the answer to part (c) above? g) If, after hedging, the price of the pound rises to $1.72, what is the maximum amount the portfolio manager can gain? Why is this answer different from the answer to part (d) above

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts