Question: please use excel to solve and show all work A hardiware company is considering replacing an old, fully depreciated power machine. Two options are available:

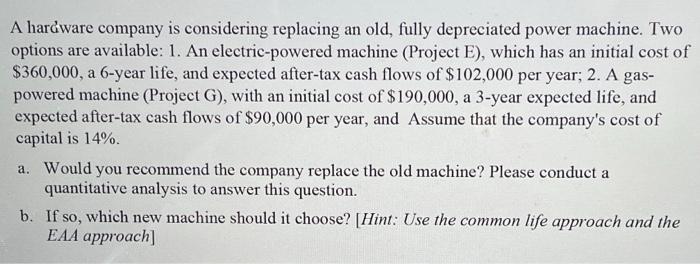

A hardiware company is considering replacing an old, fully depreciated power machine. Two options are available: 1 . An electric-powered machine (Project E), which has an initial cost of $360,000, a 6-year life, and expected after-tax cash flows of $102,000 per year; 2. A gaspowered machine (Project G), with an initial cost of $190,000, a 3-year expected life, and expected after-tax cash flows of $90,000 per year, and Assume that the company's cost of capital is 14%. a. Would you recommend the company replace the old machine? Please conduct a quantitative analysis to answer this question. b. If so, which new machine should it choose? [Hint: Use the common life approach and the EAA approach]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts