Question: Please use excel to solve the problem, show the steps and calculations Q4. (16 points) Imagine a firm whose cash flows depend on the state

Please use excel to solve the problem, show the steps and calculations

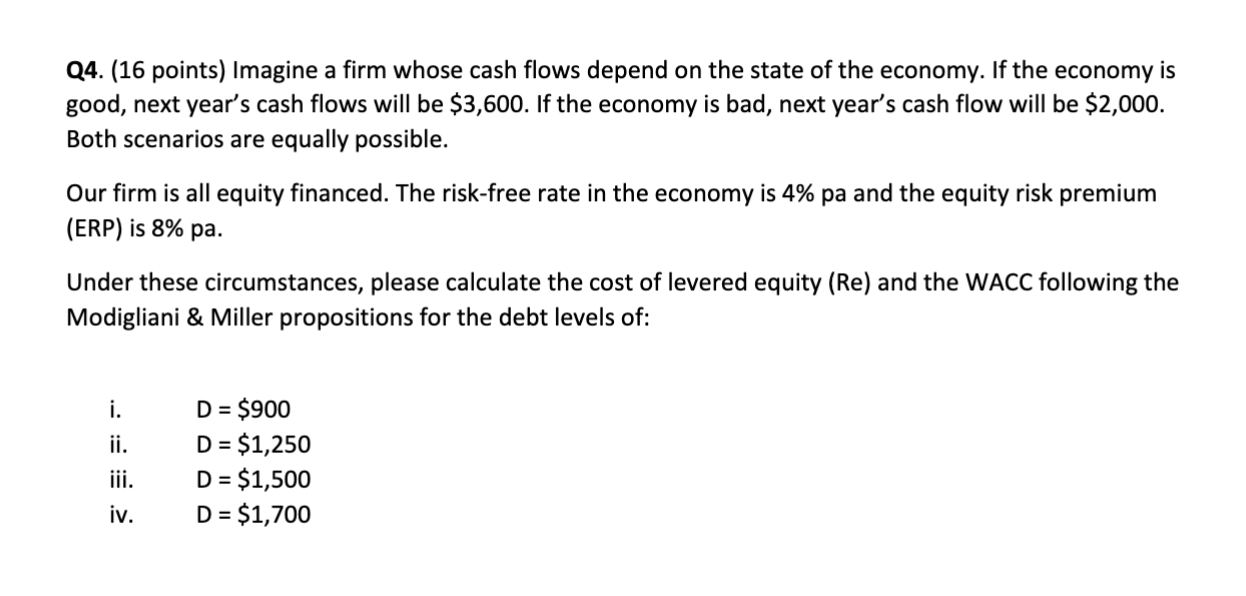

Q4. (16 points) Imagine a firm whose cash flows depend on the state of the economy. If the economy is good, next year's cash flows will be $3,600. If the economy is bad, next year's cash flow will be $2,000. Both scenarios are equally possible. Our firm is all equity financed. The risk-free rate in the economy is 4% pa and the equity risk premium (ERP) is 8% pa. Under these circumstances, please calculate the cost of levered equity (Re) and the WACC following the Modigliani \& Miller propositions for the debt levels of: i. D=$900 ii. D=$1,250 iii. D=$1,500 iv. D=$1,700

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts