Question: please use excel to support your answer You are considering an investment in the common stock of Crisp's Cookware. The stock is expected to pay

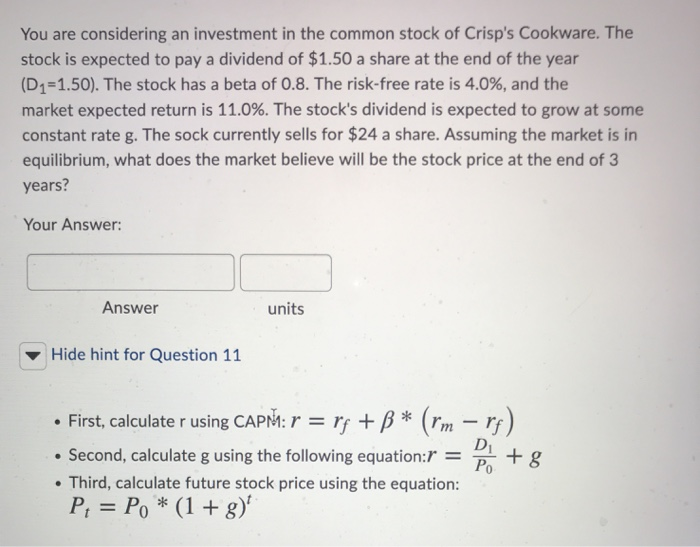

You are considering an investment in the common stock of Crisp's Cookware. The stock is expected to pay a dividend of $1.50 a share at the end of the year (D 1=1.50). The stock has a beta of 0.8. The risk-free rate is 4.0%, and the market expected return is 11.0%. The stock's dividend is expected to grow at some constant rate g. The sock currently sells for $24 a share. Assuming the market is in equilibrium, what does the market believe will be the stock price at the end of 3 years? Your Answer: Answer units Hide hint for Question 11 First, calculate r using CAPM: r = rf +B* (rm rf) ation:r = pi +g . Second, calculate g using the following equation:r = Third, calculate future stock price using the equation: P1 = P* (1 + 8)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts