Question: please use factor notations Incremental IRR (%), when compared with alternative Alternative IRR (%) B 28.9 Initial Alternative investment (IL) 25,000 35,000 c 40,000 D

please use factor notations

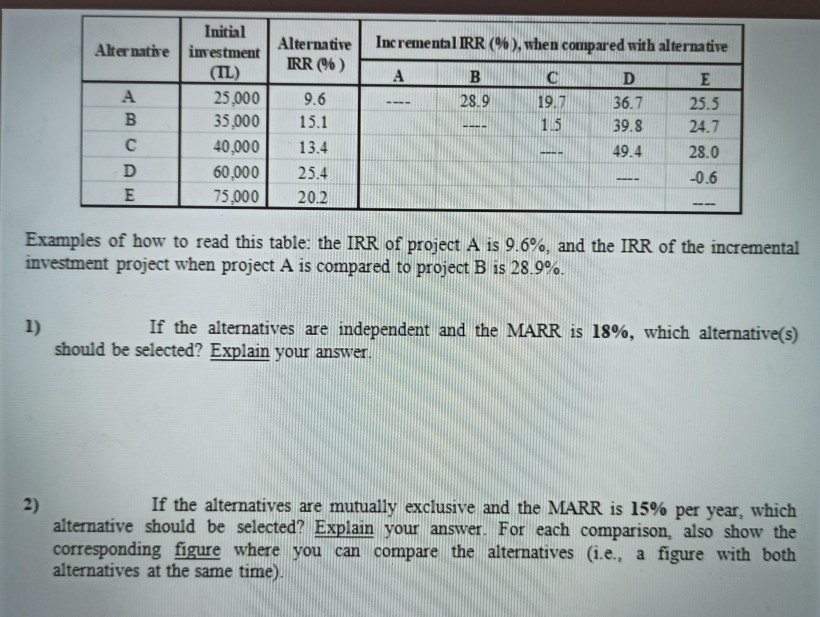

Incremental IRR (%), when compared with alternative Alternative IRR (%) B 28.9 Initial Alternative investment (IL) 25,000 35,000 c 40,000 D 60,000 E 75,000 19.7 1.5 D 36.7 39.8 49.4 E 25.5 24.7 9.6 15.1 13.4 25.4 20.2 ---- 28.0 -0.6 -- Examples of how to read this table: the IRR of project A is 9.6%, and the IRR of the incremental investment project when project A is compared to project B is 28.9%. 1) If the alternatives are independent and the MARR is 18%, which alternative(s) should be selected? Explain your answer. 2) If the alternatives are mutually exclusive and the MARR is 15% per year, which alternative should be selected? Explain your answer. For each comparison, also show the corresponding figure where you can compare the alternatives (ie, a figure with both alternatives at the same time). Incremental IRR (%), when compared with alternative Alternative IRR (%) B 28.9 Initial Alternative investment (IL) 25,000 35,000 c 40,000 D 60,000 E 75,000 19.7 1.5 D 36.7 39.8 49.4 E 25.5 24.7 9.6 15.1 13.4 25.4 20.2 ---- 28.0 -0.6 -- Examples of how to read this table: the IRR of project A is 9.6%, and the IRR of the incremental investment project when project A is compared to project B is 28.9%. 1) If the alternatives are independent and the MARR is 18%, which alternative(s) should be selected? Explain your answer. 2) If the alternatives are mutually exclusive and the MARR is 15% per year, which alternative should be selected? Explain your answer. For each comparison, also show the corresponding figure where you can compare the alternatives (ie, a figure with both alternatives at the same time)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts