Question: Please use formulas instead of excel to solve this 2. Random returns for two well-diversified portfolios at time t are given by: At = :

Please use formulas instead of excel to solve this

Please use formulas instead of excel to solve this

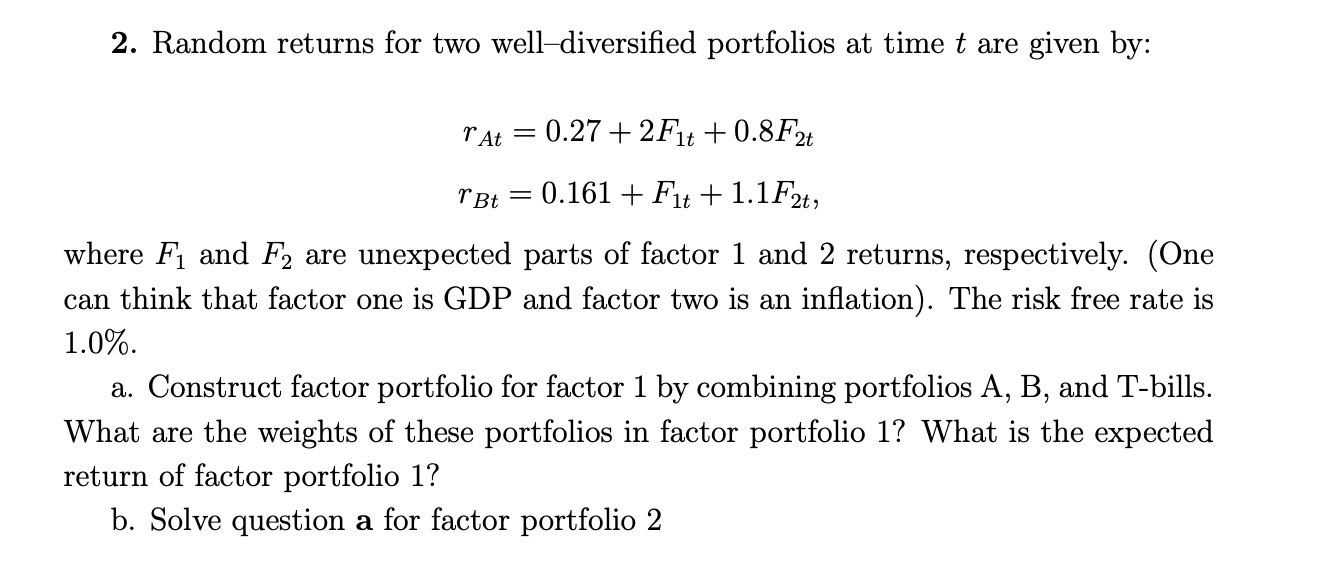

2. Random returns for two well-diversified portfolios at time t are given by: "At = : 0.27 +2Ft +0.8F2t TBt = 0.161 + Fit + 1.1F2t, where F and F2 are unexpected parts of factor 1 and 2 returns, respectively. (One can think that factor one is GDP and factor two is an inflation). The risk free rate is 1.0%. a. Construct factor portfolio for factor 1 by combining portfolios A, B, and T-bills. What are the weights of these portfolios in factor portfolio 1? What is the expected return of factor portfolio 1? b. Solve question a for factor portfolio 2

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock