Question: Please use formulas to solve it (1 pt) An invester is concerned about interest rate risk and decides to lock in a fixed interest rate

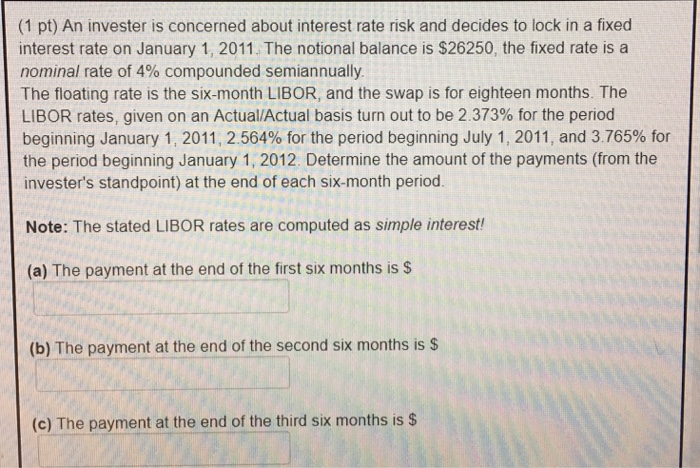

(1 pt) An invester is concerned about interest rate risk and decides to lock in a fixed interest rate on January 1, 2011. The notional balance is $26250, the fixed rate is a nominal rate of 4% compounded semiannually The floating rate is the six-month LIBOR, and the swap is for eighteen months. The LIBOR rates, given on an Actual/Actual basis turn out to be 2.373% for the period beginning January 1 , 2011, 2.564% for the period beginning July 1, 2011, and 3765% for the period beginning January 1, 2012. Determine the amount of the payments (from the invester's standpoint) at the end of each six-month period. Note: The stated LIBOR rates are computed as simple interest! (a) The payment at the end of the first six months is S (b) The payment at the end of the second six months is $ (c) The payment at the end of the third six months is $

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts