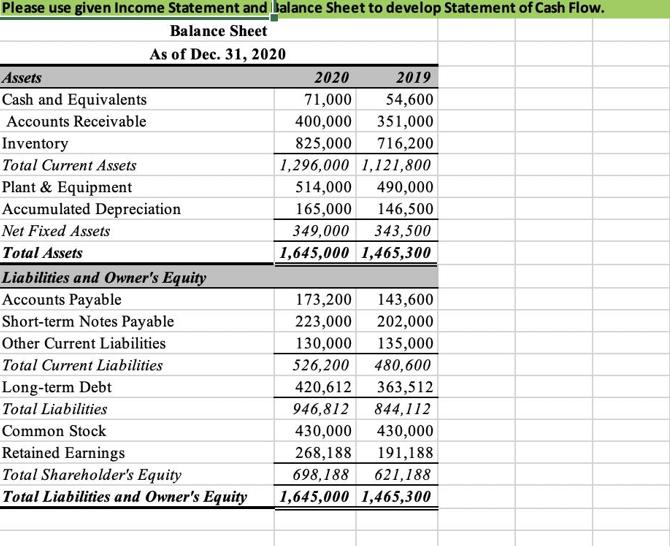

Question: Please use given Income Statement and Balance Sheet to develop Statement of Cash Flow. Balance Sheet As of Dec. 31, 2020 Assets Cash and

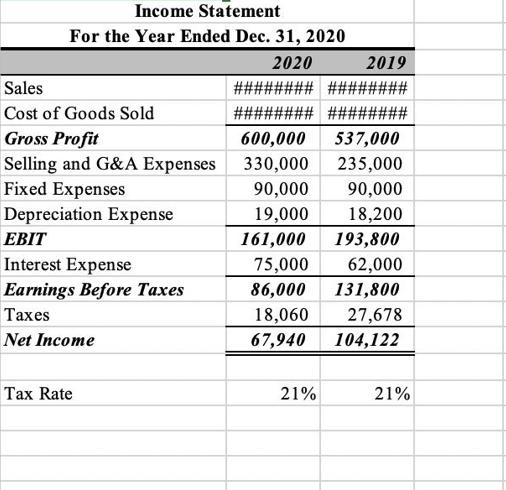

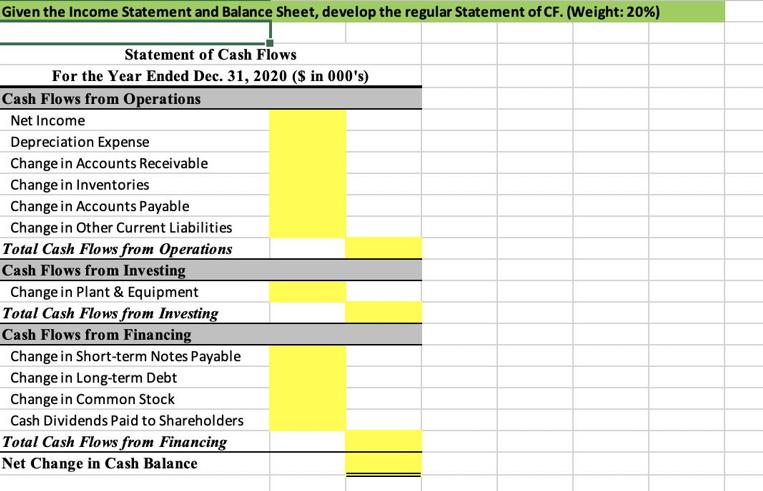

Please use given Income Statement and Balance Sheet to develop Statement of Cash Flow. Balance Sheet As of Dec. 31, 2020 Assets Cash and Equivalents Accounts Receivable Inventory Total Current Assets Plant & Equipment Accumulated Depreciation Net Fixed Assets Total Assets Liabilities and Owner's Equity Accounts Payable Short-term Notes Payable Other Current Liabilities Total Current Liabilities Long-term Debt Total Liabilities Common Stock Retained Earnings Total Shareholder's Equity Total Liabilities and Owner's Equity 2020 2019 71,000 54,600 400,000 351,000 825,000 716,200 1,296,000 1,121,800 514,000 490,000 165,000 146,500 349,000 343,500 1,645,000 1,465,300 173,200 143,600 223,000 202,000 130,000 135,000 526,200 480,600 420,612 363,512 946,812 844,112 430,000 430,000 268,188 191,188 698,188 621,188 1,645,000 1,465,300 Income Statement For the Year Ended Dec. 31, 2020 2020 Sales Cost of Goods Sold Gross Profit Selling and G&A Expenses Fixed Expenses Depreciation Expense EBIT Interest Expense Earnings Before Taxes Taxes Net Income Tax Rate 2019 ######## ######## ######## ######## 600,000 537,000 330,000 235,000 90,000 90,000 19,000 18,200 161,000 193,800 75,000 62,000 86,000 131,800 18,060 27,678 67,940 104,122 21% 21% Given the Income Statement and Balance Sheet, develop the regular Statement of CF. (Weight: 20%) Statement of Cash Flows For the Year Ended Dec. 31, 2020 ($ in 000's) Cash Flows from Operations Net Income Depreciation Expense Change in Accounts Receivable Change in Inventories Change in Accounts Payable Change in Other Current Liabilities Total Cash Flows from Operations Cash Flows from Investing Change in Plant & Equipment Total Cash Flows from Investing Cash Flows from Financing Change in Short-term Notes Payable Change in Long-term Debt Change in Common Stock Cash Dividends Paid to Shareholders Total Cash Flows from Financing Net Change in Cash Balance Please use given Income Statement and Balance Sheet to develop Statement of Cash Flow. Balance Sheet As of Dec. 31, 2020 Assets Cash and Equivalents Accounts Receivable Inventory Total Current Assets Plant & Equipment Accumulated Depreciation Net Fixed Assets Total Assets Liabilities and Owner's Equity Accounts Payable Short-term Notes Payable Other Current Liabilities Total Current Liabilities Long-term Debt Total Liabilities Common Stock Retained Earnings Total Shareholder's Equity Total Liabilities and Owner's Equity 2020 2019 71,000 54,600 400,000 351,000 825,000 716,200 1,296,000 1,121,800 514,000 490,000 165,000 146,500 349,000 343,500 1,645,000 1,465,300 173,200 143,600 223,000 202,000 130,000 135,000 526,200 480,600 420,612 363,512 946,812 844,112 430,000 430,000 268,188 191,188 698,188 621,188 1,645,000 1,465,300 Income Statement For the Year Ended Dec. 31, 2020 2020 Sales Cost of Goods Sold Gross Profit Selling and G&A Expenses Fixed Expenses Depreciation Expense EBIT Interest Expense Earnings Before Taxes Taxes Net Income Tax Rate 2019 ######## ######## ######## ######## 600,000 537,000 330,000 235,000 90,000 90,000 19,000 18,200 161,000 193,800 75,000 62,000 86,000 131,800 18,060 27,678 67,940 104,122 21% 21% Given the Income Statement and Balance Sheet, develop the regular Statement of CF. (Weight: 20%) Statement of Cash Flows For the Year Ended Dec. 31, 2020 ($ in 000's) Cash Flows from Operations Net Income Depreciation Expense Change in Accounts Receivable Change in Inventories Change in Accounts Payable Change in Other Current Liabilities Total Cash Flows from Operations Cash Flows from Investing Change in Plant & Equipment Total Cash Flows from Investing Cash Flows from Financing Change in Short-term Notes Payable Change in Long-term Debt Change in Common Stock Cash Dividends Paid to Shareholders Total Cash Flows from Financing Net Change in Cash Balance

Step by Step Solution

3.34 Rating (154 Votes )

There are 3 Steps involved in it

Answer To develop the Statement of Cash Flows well start with the Cash Flow... View full answer

Get step-by-step solutions from verified subject matter experts