Question: please use jupyter python for codes function (a) Describe and distinguish the differences between a call and a put option. What is an investor's outlook

please use jupyter python for codes function

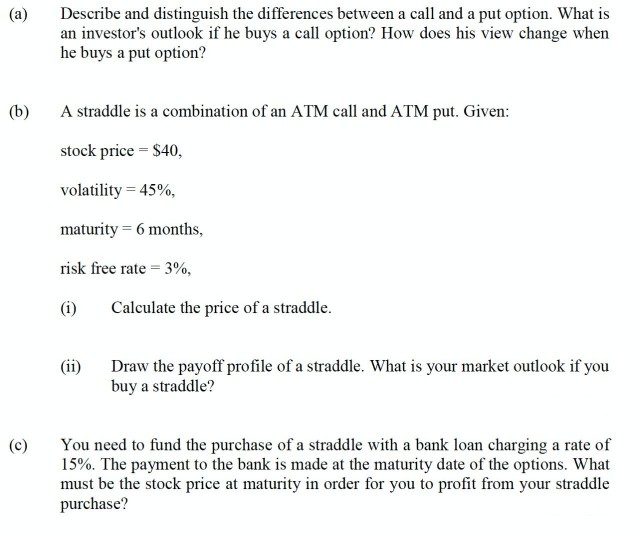

(a) Describe and distinguish the differences between a call and a put option. What is an investor's outlook if he buys a call option? How does his view change when he buys a put option? (b) A straddle is a combination of an ATM call and ATM put. Given: stock price = $40, volatility = 45% maturity = 6 months, risk free rate = 3%, (i) Calculate the price of a straddle. (ii) Draw the payoff profile of a straddle. What is your market outlook if you buy a straddle? (C) You need to fund the purchase of a straddle with a bank loan charging a rate of 15%. The payment to the bank is made at the maturity date of the options. What must be the stock price at maturity in order for you to profit from your straddle purchase

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts