Question: PLEASE USE LINGO OR EXCEL AND SHOW ALL WORKOUTS INSIDE THE SAID APPLICATIONS James is planing an investment strategy for a four-year period, which the

PLEASE USE LINGO OR EXCEL AND SHOW ALL WORKOUTS INSIDE THE SAID APPLICATIONS

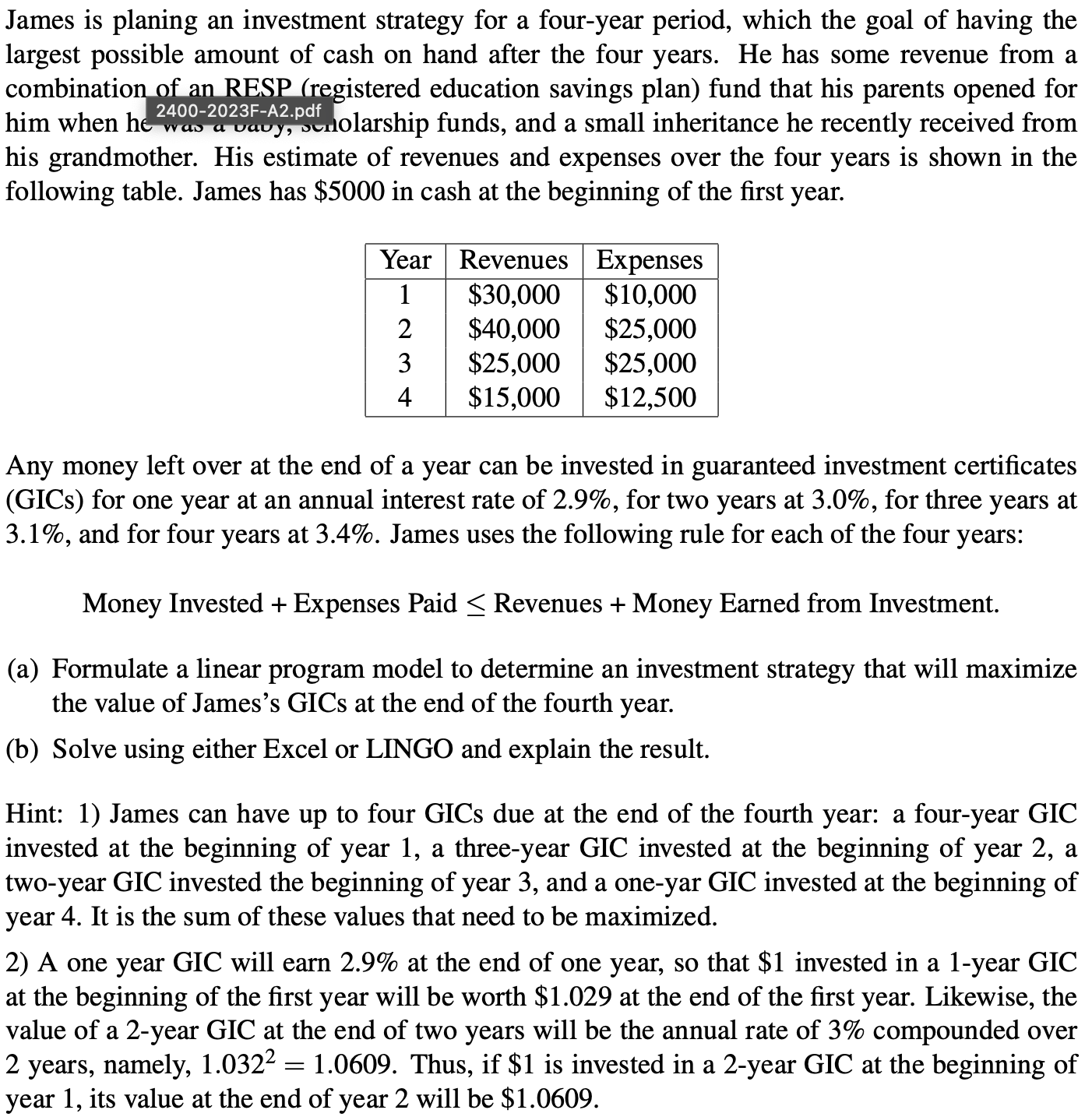

James is planing an investment strategy for a four-year period, which the goal of having the largest possible amount of cash on hand after the four years. He has some revenue from a combination of an RESP (registered education savings plan) fund that his parents opened for him when he was a vavy, surnolarship funds, and a small inheritance he recently received from his grandmother. His estimate of revenues and expenses over the four years is shown in the following table. James has $5000 in cash at the beginning of the first year. Any money left over at the end of a year can be invested in guaranteed investment certificates (GICs) for one year at an annual interest rate of 2.9%, for two years at 3.0%, for three years at 3.1%, and for four years at 3.4%. James uses the following rule for each of the four years: Money Invested + Expenses Paid Revenues + Money Earned from Investment. (a) Formulate a linear program model to determine an investment strategy that will maximize the value of James's GICs at the end of the fourth year. (b) Solve using either Excel or LINGO and explain the result. Hint: 1) James can have up to four GICs due at the end of the fourth year: a four-year GIC invested at the beginning of year 1, a three-year GIC invested at the beginning of year 2, a two-year GIC invested the beginning of year 3, and a one-yar GIC invested at the beginning of year 4. It is the sum of these values that need to be maximized. 2) A one year GIC will earn 2.9% at the end of one year, so that \$1 invested in a 1-year GIC at the beginning of the first year will be worth $1.029 at the end of the first year. Likewise, the value of a 2 -year GIC at the end of two years will be the annual rate of 3% compounded over 2 years, namely, 1.0322=1.0609. Thus, if $1 is invested in a 2 -year GIC at the beginning of year 1 , its value at the end of year 2 will be $1.0609

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts