Question: Please use Mathematica program to solve this question Question 2 You have a portfolio with estimated monthly mean return of 0.8% and monthly standard deviation

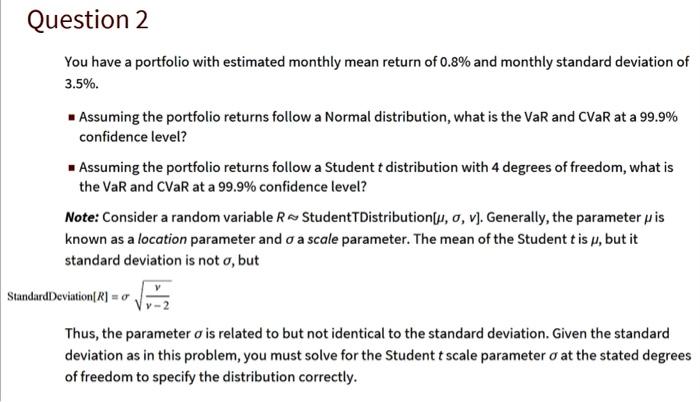

Question 2 You have a portfolio with estimated monthly mean return of 0.8% and monthly standard deviation of 3.5%. Assuming the portfolio returns follow a Normal distribution, what is the VaR and CVaR at a 99.9% confidence level? Assuming the portfolio returns follow a Student t distribution with 4 degrees of freedom, what is the VaR and CVaR at a 99.9% confidence level? Note: Consider a random variable R StudentTDistribution[u, o, v). Generally, the parameter pis known as a location parameter and o a scale parameter. The mean of the Student tis , but it standard deviation is not o, but StandardDeviation[ R] = 0 Thus, the parameter o is related to but not identical to the standard deviation. Given the standard deviation as in this problem, you must solve for the Student t scale parameter o at the stated degrees of freedom to specify the distribution correctly. Question 2 You have a portfolio with estimated monthly mean return of 0.8% and monthly standard deviation of 3.5%. Assuming the portfolio returns follow a Normal distribution, what is the VaR and CVaR at a 99.9% confidence level? Assuming the portfolio returns follow a Student t distribution with 4 degrees of freedom, what is the VaR and CVaR at a 99.9% confidence level? Note: Consider a random variable R StudentTDistribution[u, o, v). Generally, the parameter pis known as a location parameter and o a scale parameter. The mean of the Student tis , but it standard deviation is not o, but StandardDeviation[ R] = 0 Thus, the parameter o is related to but not identical to the standard deviation. Given the standard deviation as in this problem, you must solve for the Student t scale parameter o at the stated degrees of freedom to specify the distribution correctly

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts