Question: Please use ONLY an Excel spreadsheet for the solutionsno handwritten ones. 20. You purchase a Treasury-bond futures contract with an initial margin requirement of 30%

Please use ONLY an Excel spreadsheet for the solutionsno handwritten ones.

Please use ONLY an Excel spreadsheet for the solutionsno handwritten ones.

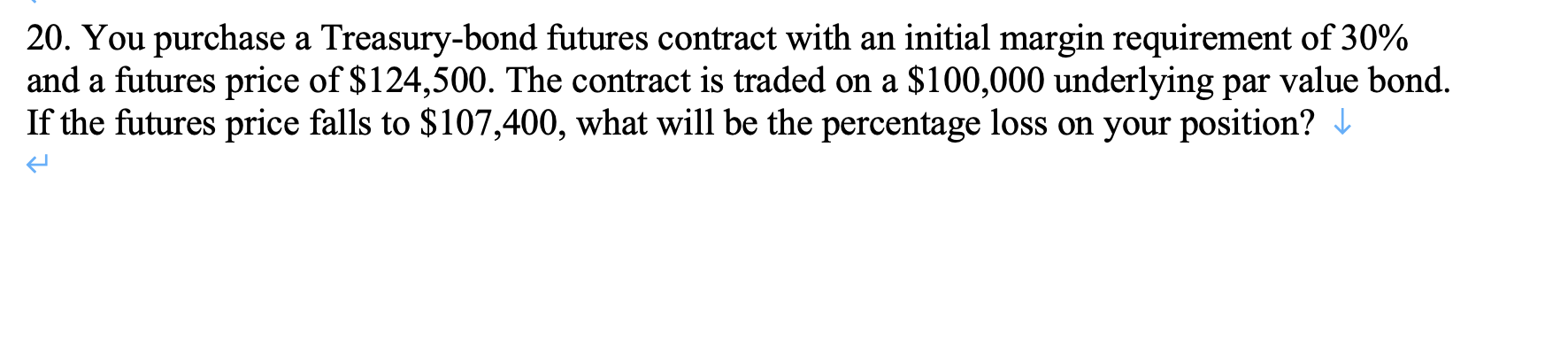

20. You purchase a Treasury-bond futures contract with an initial margin requirement of 30% and a futures price of $124,500. The contract is traded on a $100,000 underlying par value bond. If the futures price falls to $107,400, what will be the percentage loss on your position

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts