Question: please use only Excel program and show all calculations. ty! Fleming Golf has decided to sell a new line of golf clubs. The clubs will

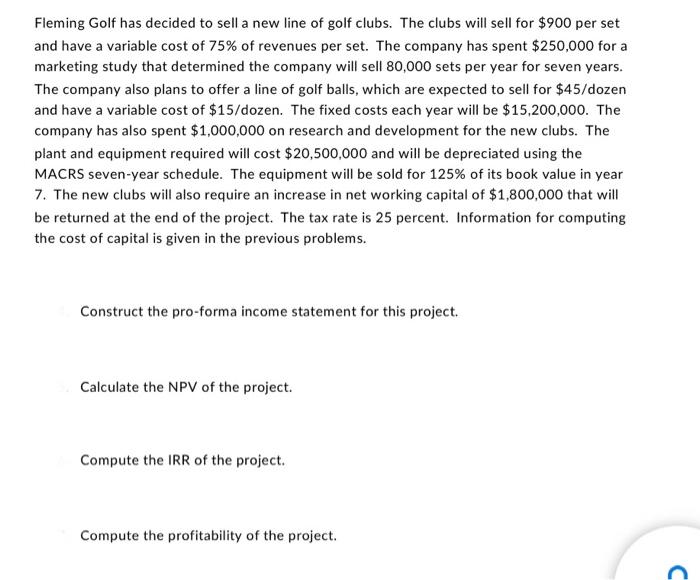

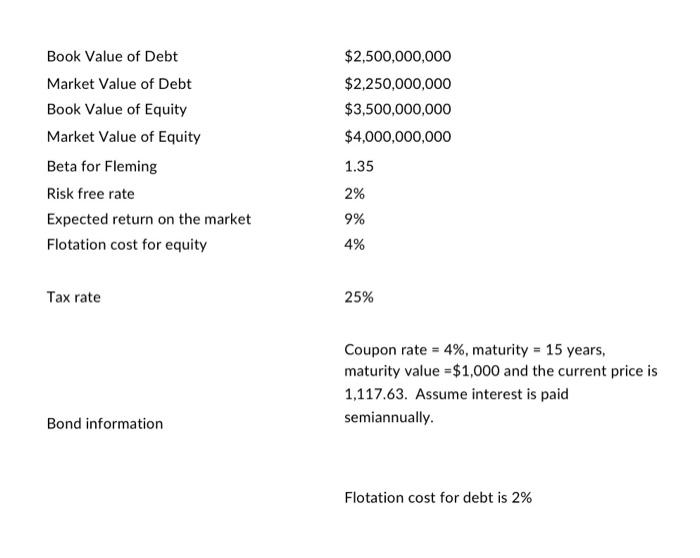

Fleming Golf has decided to sell a new line of golf clubs. The clubs will sell for $900 per set and have a variable cost of 75% of revenues per set. The company has spent $250,000 for a marketing study that determined the company will sell 80,000 sets per year for seven years. The company also plans to offer a line of golf balls, which are expected to sell for $45/ dozen and have a variable cost of $15 /dozen. The fixed costs each year will be $15,200,000. The company has also spent $1,000,000 on research and development for the new clubs. The plant and equipment required will cost $20,500,000 and will be depreciated using the MACRS seven-year schedule. The equipment will be sold for 125% of its book value in year 7. The new clubs will also require an increase in net working capital of $1,800,000 that will be returned at the end of the project. The tax rate is 25 percent. Information for computing the cost of capital is given in the previous problems. Construct the pro-forma income statement for this project. Calculate the NPV of the project. Compute the IRR of the project. Compute the profitability of the project. Flotation cost for debt is 2% Fleming Golf has decided to sell a new line of golf clubs. The clubs will sell for $900 per set and have a variable cost of 75% of revenues per set. The company has spent $250,000 for a marketing study that determined the company will sell 80,000 sets per year for seven years. The company also plans to offer a line of golf balls, which are expected to sell for $45/ dozen and have a variable cost of $15 /dozen. The fixed costs each year will be $15,200,000. The company has also spent $1,000,000 on research and development for the new clubs. The plant and equipment required will cost $20,500,000 and will be depreciated using the MACRS seven-year schedule. The equipment will be sold for 125% of its book value in year 7. The new clubs will also require an increase in net working capital of $1,800,000 that will be returned at the end of the project. The tax rate is 25 percent. Information for computing the cost of capital is given in the previous problems. Construct the pro-forma income statement for this project. Calculate the NPV of the project. Compute the IRR of the project. Compute the profitability of the project. Flotation cost for debt is 2%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts