Question: PLEASE USE PROVIDED FORMAT FOR ANSWERS: ANSWERS NEEDED 6&7: Format needed: The comparative financial statements of the Summer Company are as follows. The market price

PLEASE USE PROVIDED FORMAT FOR ANSWERS:

ANSWERS NEEDED 6&7:

Format needed:

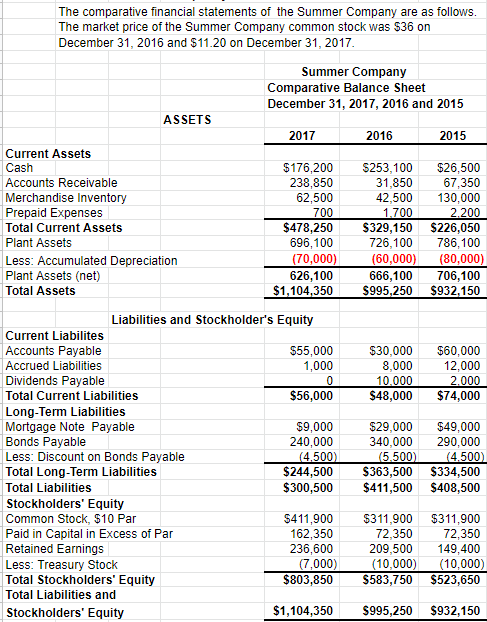

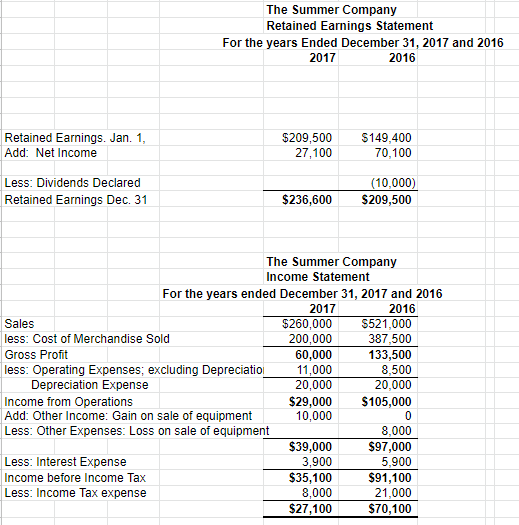

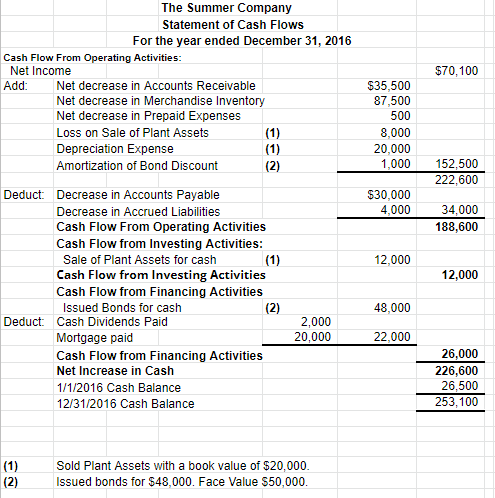

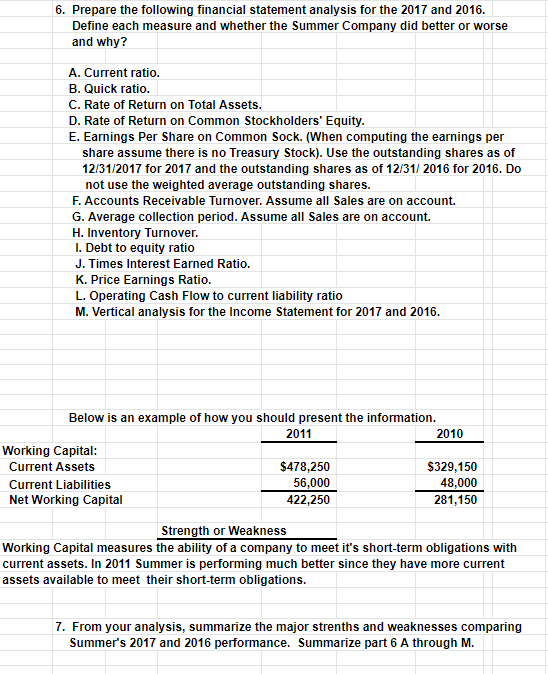

The comparative financial statements of the Summer Company are as follows. The market price of the Summer Company common stock was $36 on December 31,2016 and $11.20 on December 31,2017 . (1) Sold Plant Assets with a book value of $20,000. (2) Issued bonds for $48,000. Face Value $50,000. 6. Prepare the following financial statement analysis for the 2017 and 2016. Define each measure and whether the Summer Company did better or worse and why? A. Current ratio. B. Quick ratio. C. Rate of Return on Total Assets. D. Rate of Return on Common Stockholders' Equity. E. Earnings Per Share on Common Sock. (When computing the earnings per share assume there is no Treasury Stock). Use the outstanding shares as of 12/31/2017 for 2017 and the outstanding shares as of 12/31/2016 for 2016 . Do not use the weighted average outstanding shares. F. Accounts Receivable Turnover. Assume all Sales are on account. G. Average collection period. Assume all Sales are on account. H. Inventory Turnover. I. Debt to equity ratio J. Times Interest Earned Ratio. K. Price Earnings Ratio. L. Operating Cash Flow to current liability ratio M. Vertical analysis for the Income Statement for 2017 and 2016. Relnw is an pyamnle af how voul shnould nresent the information Working Capital measures the ability of a company to meet it's short-term obligations with current assets. In 2011 Summer is performing much better since they have more current assets available to meet their short-term obligations. 7. From your analysis, summarize the major strenths and weaknesses comparing Summer's 2017 and 2016 performance. Summarize part 6 A through M. PART 6 L. Vertical Analysis 2017 2016 Strengths and Weaknesses

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts