Question: PLEASE USE PROVIDED FORMAT: KO: PEP: REQUIRED FORMAT: Do the following for KO and PEP for the year ended 12/31/21 only A. Perform a vertical

PLEASE USE PROVIDED FORMAT:

KO:

PEP:

REQUIRED FORMAT:

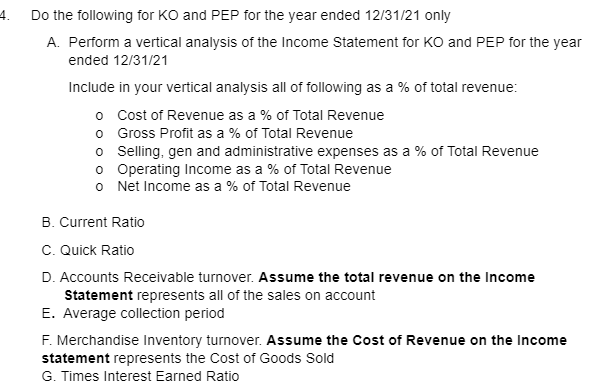

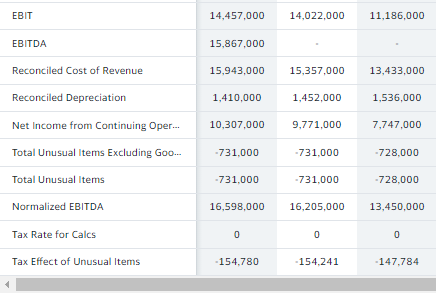

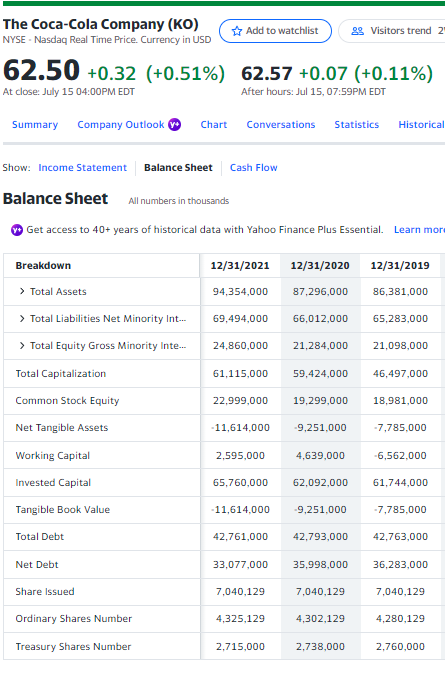

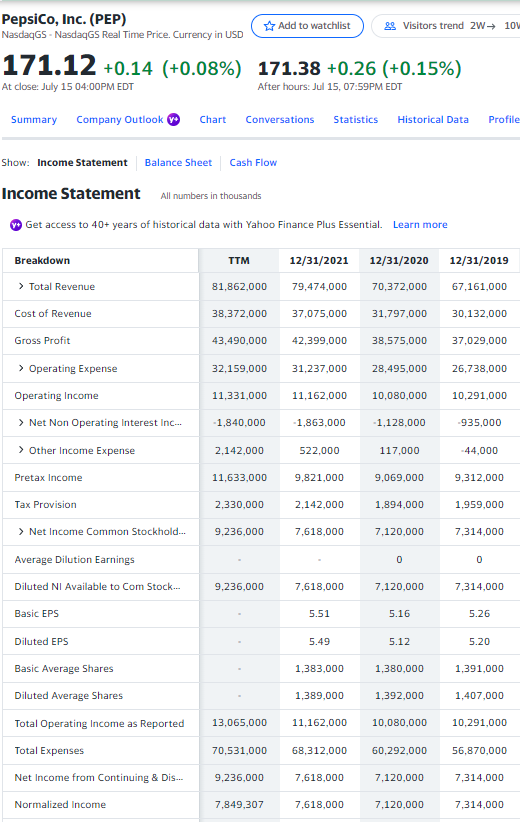

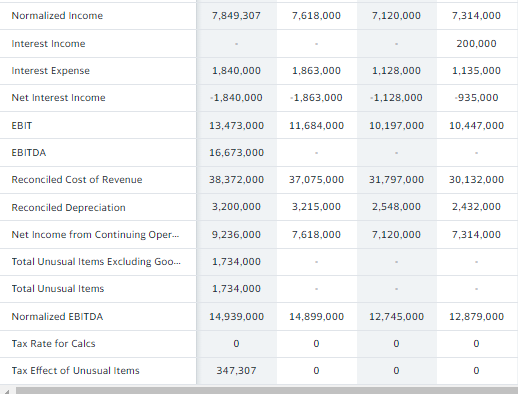

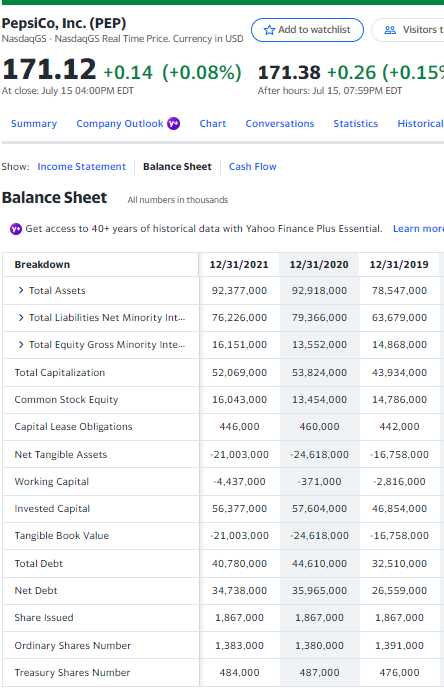

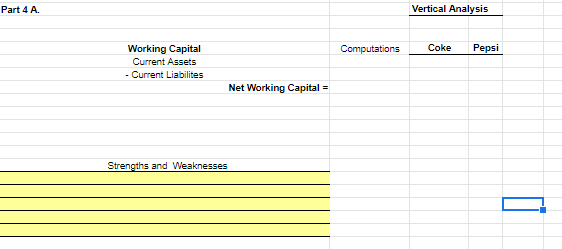

Do the following for KO and PEP for the year ended 12/31/21 only A. Perform a vertical analysis of the Income Statement for KO and PEP for the yea ended 12/31/21 Include in your vertical analysis all of following as a \% of total revenue: - Cost of Revenue as a \% of Total Revenue - Gross Profit as a \% of Total Revenue - Selling, gen and administrative expenses as a \% of Total Revenue - Operating Income as a \% of Total Revenue o Net Income as a \% of Total Revenue B. Current Ratio C. Quick Ratio D. Accounts Receivable turnover. Assume the total revenue on the Income Statement represents all of the sales on account E. Average collection period F. Merchandise Inventory turnover. Assume the Cost of Revenue on the Income statement represents the Cost of Goods Sold G. Times Interest Earned Ratio Income Statement All numbers in thousands Get access to 40+ years of historical data with Yahoo Finance Plus Essential. Lear Balance Sheet All numbers in thousands Get access to 40+ years of historical data with Yahoo Finance Plus Essential. Leari Get access to 40+ years of historical data with Yahoo Finance Plus Essential. ( w Get access to 40+ years of historical data with Yahoo Finance Plus Essential. Part 4 A. Vertical Analysis Working Capital Computations Coke Pepsi Current Assets - Current Liabilites Net Working Capital = Strengths and Weaknesses Do the following for KO and PEP for the year ended 12/31/21 only A. Perform a vertical analysis of the Income Statement for KO and PEP for the yea ended 12/31/21 Include in your vertical analysis all of following as a \% of total revenue: - Cost of Revenue as a \% of Total Revenue - Gross Profit as a \% of Total Revenue - Selling, gen and administrative expenses as a \% of Total Revenue - Operating Income as a \% of Total Revenue o Net Income as a \% of Total Revenue B. Current Ratio C. Quick Ratio D. Accounts Receivable turnover. Assume the total revenue on the Income Statement represents all of the sales on account E. Average collection period F. Merchandise Inventory turnover. Assume the Cost of Revenue on the Income statement represents the Cost of Goods Sold G. Times Interest Earned Ratio Income Statement All numbers in thousands Get access to 40+ years of historical data with Yahoo Finance Plus Essential. Lear Balance Sheet All numbers in thousands Get access to 40+ years of historical data with Yahoo Finance Plus Essential. Leari Get access to 40+ years of historical data with Yahoo Finance Plus Essential. ( w Get access to 40+ years of historical data with Yahoo Finance Plus Essential. Part 4 A. Vertical Analysis Working Capital Computations Coke Pepsi Current Assets - Current Liabilites Net Working Capital = Strengths and Weaknesses

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts