Question: Please use r-studio and give the coding as well. 3. Considering the issue of volatility modelling, compare the volatility estimation using the VIX index and

Please use r-studio and give the coding as well.

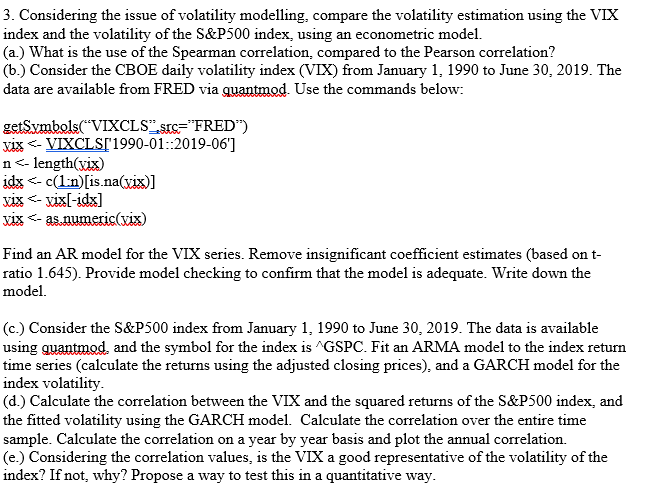

3. Considering the issue of volatility modelling, compare the volatility estimation using the VIX index and the volatility of the S\&P500 index, using an econometric model. (a.) What is the use of the Spearman correlation, compared to the Pearson correlation? (b.) Consider the CBOE daily volatility index (VIX) from January 1, 1990 to June 30, 2019. The data are available from FRED via quantmod. Use the commands below: getSxmbols( "VIXCLS ssc ="FRED") xix

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts