Question: Please use & show Excel formula to produce answer so I can learn Refer to Table 3.6. If the spot interest rates change to the

Please use & show Excel formula to produce answer so I can learn

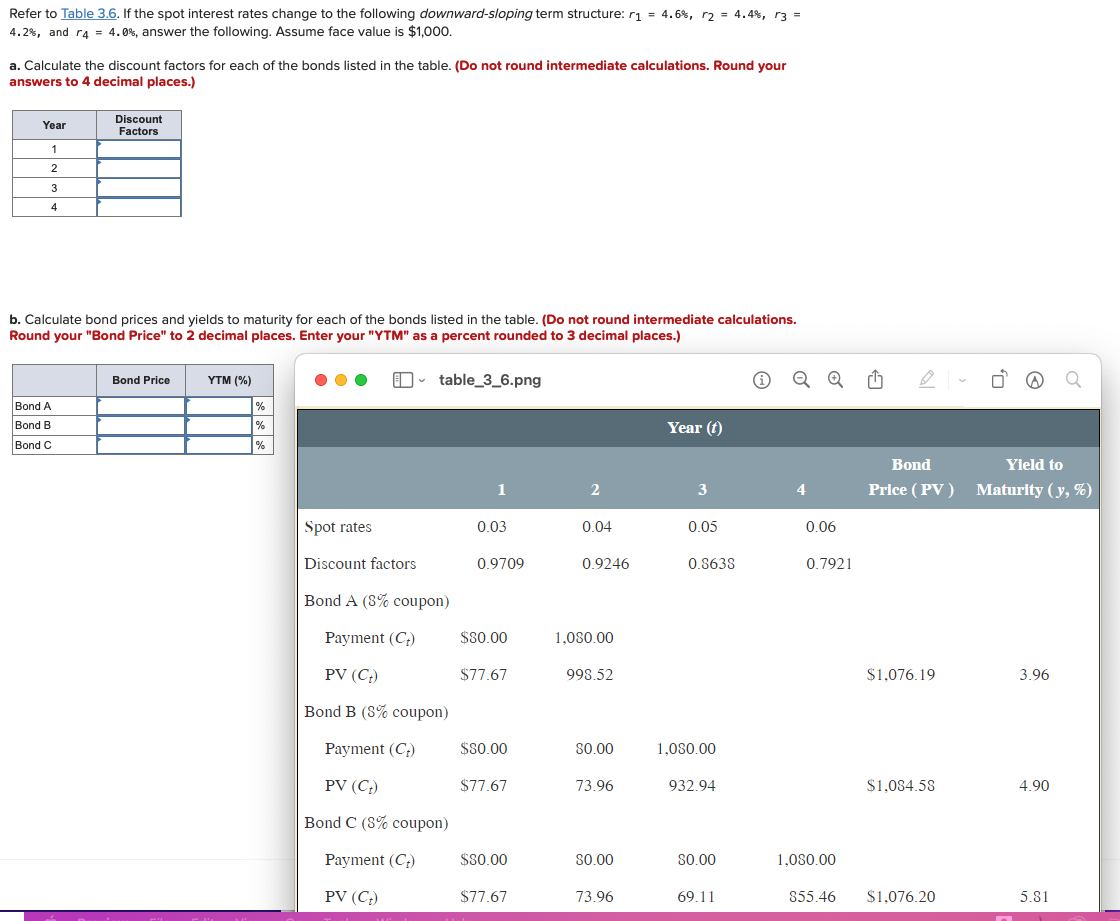

Refer to Table 3.6. If the spot interest rates change to the following downward-sloping term structure: r1 = 4.6%, 12 = 4.4%, 13 = 4.2%, and r4 = 4.0%, answer the following. Assume face value is $1,000. a. Calculate the discount factors for each of the bonds listed in the table. (Do not round intermediate calculations. Round your answers to 4 decimal places.) Year Discount Factors 1 2 3 4 b. Calculate bond prices and yields to maturity for each of the bonds listed in the table. (Do not round intermediate calculations. Round your "Bond Price" to 2 decimal places. Enter your "YTM" as a percent rounded to 3 decimal places.) Bond Price YTM (%) 1 table_3_6.png % Bond A Bond B Bond C % Year (t) % Bond Yield to Price (PV) Maturity (y,%) 1 2 3 4 Spot rates 0.03 0.04 0.05 0.06 Discount factors 0.9709 0.9246 0.8638 0.7921 Bond A (8% coupon) Payment (C) $80.00 1,080.00 PV (C) $77.67 998.52 $1.076.19 3.96 Bond B (8% coupon) Payment (CD) $80.00 80.00 1,080.00 PV (C) $77.67 73.96 932.94 $1,084.58 4.90 Bond C (8% coupon) Payment (C) $80.00 80.00 S0.00 1,080.00 PV (C) $77.67 73.96 69.11 855.46 $1.076.20 5.81 Refer to Table 3.6. If the spot interest rates change to the following downward-sloping term structure: r1 = 4.6%, 12 = 4.4%, 13 = 4.2%, and r4 = 4.0%, answer the following. Assume face value is $1,000. a. Calculate the discount factors for each of the bonds listed in the table. (Do not round intermediate calculations. Round your answers to 4 decimal places.) Year Discount Factors 1 2 3 4 b. Calculate bond prices and yields to maturity for each of the bonds listed in the table. (Do not round intermediate calculations. Round your "Bond Price" to 2 decimal places. Enter your "YTM" as a percent rounded to 3 decimal places.) Bond Price YTM (%) 1 table_3_6.png % Bond A Bond B Bond C % Year (t) % Bond Yield to Price (PV) Maturity (y,%) 1 2 3 4 Spot rates 0.03 0.04 0.05 0.06 Discount factors 0.9709 0.9246 0.8638 0.7921 Bond A (8% coupon) Payment (C) $80.00 1,080.00 PV (C) $77.67 998.52 $1.076.19 3.96 Bond B (8% coupon) Payment (CD) $80.00 80.00 1,080.00 PV (C) $77.67 73.96 932.94 $1,084.58 4.90 Bond C (8% coupon) Payment (C) $80.00 80.00 S0.00 1,080.00 PV (C) $77.67 73.96 69.11 855.46 $1.076.20 5.81

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts