Question: please use spreadsheets and show formulas Sectic ; PLEASE DO NOT INSERT LINES OR COLUMNS AND DO NOT COPY AND PASTE FORMULAS FROM OTHER SPREADSHEETS

please use spreadsheets and show formulas

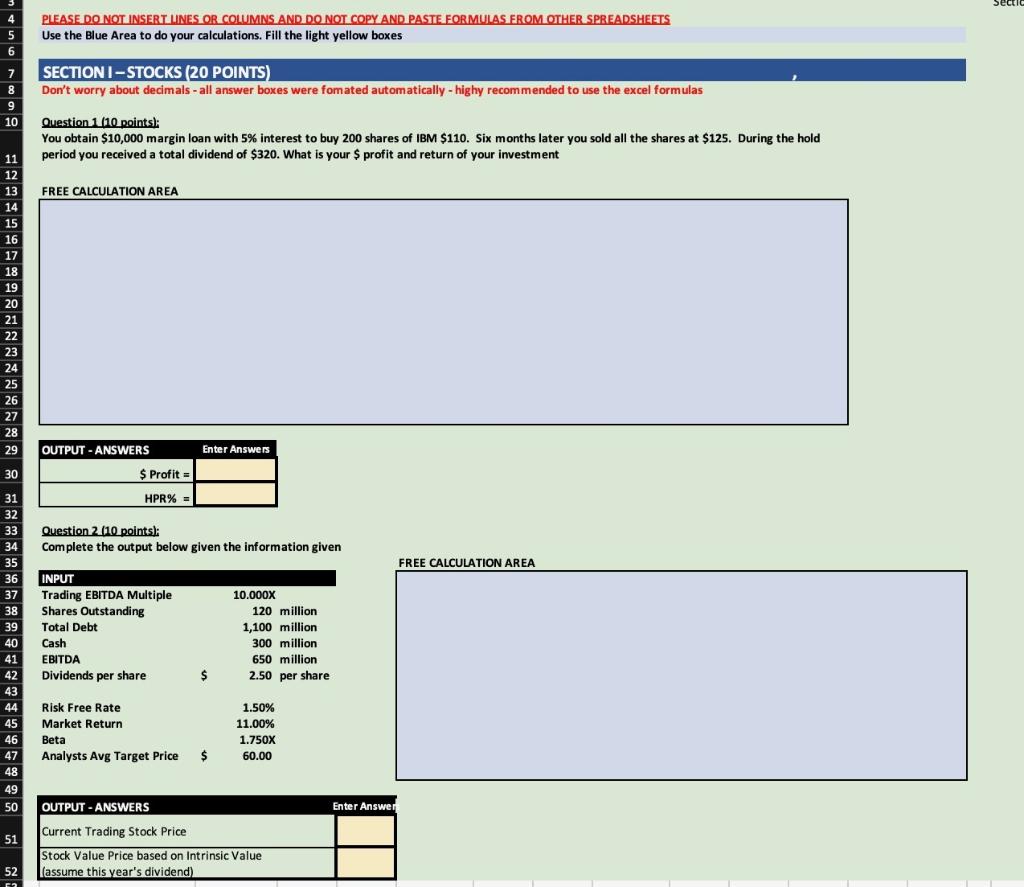

Sectic ; PLEASE DO NOT INSERT LINES OR COLUMNS AND DO NOT COPY AND PASTE FORMULAS FROM OTHER SPREADSHEETS 5 Use the Blue Area to do your calculations. Fill the light yellow boxes 6 SECTION I-STOCKS (20 POINTS) 8 Don't worry about decimals - all answer boxes were fomated automatically - highy recommended to use the excel formulas 9 10 Question 1 (10 points: You obtain $10,000 margin loan with 5% interest to buy 200 shares of IBM $110. Six months later you sold all the shares at $125. During the hold 11 period you received a total dividend of $320. What is your $ profit and return of your investment 12 13 FREE CALCULATION AREA 14 15 16 10 17 18 10 19 20 21 22 2 23 24 23 25 26 27 28 29 OUTPUT - ANSWERS Enter Answers 30 $ Profit 31 HPR% = 32 33 Question 2 (10 points): 34 Complete the output below given the information given 35 FREE CALCULATION AREA 36 INPUT 37 Trading EBITDA Multiple 10.000X 38 Shares Outstanding ve 120 million 39 Total Debt 1,100 million 40 Cash 300 million 41 650 million 42 Dividends per share $ 2.50 per share 43 44 Risk Free Rate 1.50% 45 Market Return 11.00% 46 Beta 1.750X 47 Analysts Avg Target Price $ 60.00 48 49 50 OUTPUT - ANSWERS Enter Answer Current Trading Stock Price 51 Stock Value Price based on Intrinsic Value 52 (assume this year's dividend) EBITDA Sectic ; PLEASE DO NOT INSERT LINES OR COLUMNS AND DO NOT COPY AND PASTE FORMULAS FROM OTHER SPREADSHEETS 5 Use the Blue Area to do your calculations. Fill the light yellow boxes 6 SECTION I-STOCKS (20 POINTS) 8 Don't worry about decimals - all answer boxes were fomated automatically - highy recommended to use the excel formulas 9 10 Question 1 (10 points: You obtain $10,000 margin loan with 5% interest to buy 200 shares of IBM $110. Six months later you sold all the shares at $125. During the hold 11 period you received a total dividend of $320. What is your $ profit and return of your investment 12 13 FREE CALCULATION AREA 14 15 16 10 17 18 10 19 20 21 22 2 23 24 23 25 26 27 28 29 OUTPUT - ANSWERS Enter Answers 30 $ Profit 31 HPR% = 32 33 Question 2 (10 points): 34 Complete the output below given the information given 35 FREE CALCULATION AREA 36 INPUT 37 Trading EBITDA Multiple 10.000X 38 Shares Outstanding ve 120 million 39 Total Debt 1,100 million 40 Cash 300 million 41 650 million 42 Dividends per share $ 2.50 per share 43 44 Risk Free Rate 1.50% 45 Market Return 11.00% 46 Beta 1.750X 47 Analysts Avg Target Price $ 60.00 48 49 50 OUTPUT - ANSWERS Enter Answer Current Trading Stock Price 51 Stock Value Price based on Intrinsic Value 52 (assume this year's dividend) EBITDA

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts