Question: please use strategic frameworks to answer the following Is Pfizer still capable of delivering a sustainable pipeline of profitable drugs. Does it require any major

please use strategic frameworks to answer the following

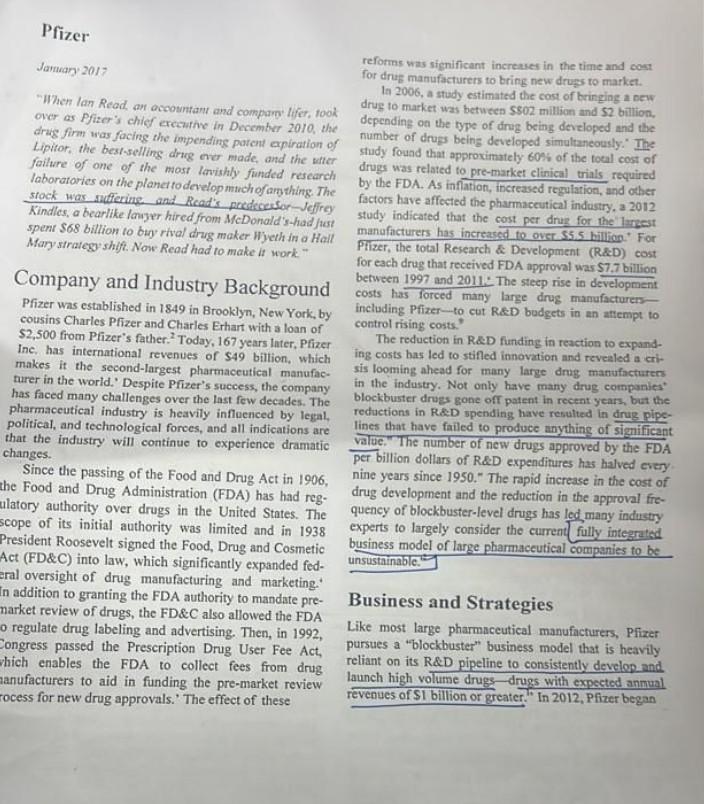

Is Pfizer still capable of delivering a sustainable pipeline of profitable drugs. Does it require any major changes in its strategy to stay ahead of its competitors. Analyse by identifying Pfizer's sources of profitability using framework and tools of Strategic Management. (Marks 15) Question 2: Analyse what could be Pfizer's motives for takeover attempts of both Astrazeneca and Allergan? What competitive advantages it would have envisaged by these takeovers. Your analysis should be based on framework of Strategic Management. (1) What could be possible advantages to ffiter from such acquisitions. How would this impact Pfirer's stobal strategy (Marks 20) Question : Identify possible opportunitles for pfizer and formulate strategies for growth and. profitability In chalfenging and dynamig business environment? should it go for vertical integration or Giversification. Explain in detail giving advantages and disadvantages of verticaTintegration and diversification. Should Plizer go for National Differentiation. Under what circumstances should such corporations go for National Differentiation explaining pros and cons of National Differentiation. (Marks 15) Section B Question 4: Zara Drand - Inditex manufactures most of the garments it sells under Zara brand. It manages its own distribution from manufacturing plants to its directly managed retail stores. On other hand Gap outsources its production and focuses upon design, marketing, and retail distribution. Should Gap backward integrate into manufacturing of garments. Explain in detail using considerations of Vertical Integration and strategic management framework. Pfizer Jamary 2017 reforms was significant increases in the time and cont for drue manufacturers to bring new drugs to market. 1a 2006, a study estimated the cost of bringing a bew "When lan Read, an accountam and compare lifer, took drug to market was between 5802 million and 52 billion, over as Pfizer's chief exezuthe in December 2010, the depending on the type of drag being developed and the drag firm was facing the impending parent expination of number of drugs being developed simultaneously:" The Lipitor, the bestwelling dragg ove made, and the after study found that approximately 60 sis of the toeal cost of failure of one of the most levishly funded research drugs was related to pre-market clinical trials, required laboratorics on the planet to develop muchofarything. The by the FDA. As inflation, fncreased regulation, and other stock was nufferime and Read's peedcoestor-Jeffrey factors have affected the pharmaceutical industry, a 2012 Kindles, a bearlike layyer hired from M/Donald's-hadfiat study indicated that the cost per drug for me'lrrest spen S68 billion to buy rival drug maker Wyeth in a Hall manaficturers has increased to over.55.5 billion." For Marystrategy shiff. Now Read had to make it work. - Pfizer, the total Research \& Development (R\&D) cost Pfizer was established in 1849 in Brooklym, New York, costs has forced many large drug manufacturerscousins Charles Pfizer and Charles Erhart, with York, by including Pfizer-to cut RED budgets in an attempt to \$2,500 from Pfizer's father. "Today, 167 years luter, Pfizer The reduction in RED funding in reaction to expandIne, has international revenues of $49 billion, which ing costs bas led to stifled innovation and revealed a crimakes it the second-largest pharmaceutical manufac- sis looming ahead for many large drag manufacturers turer in the world.' Despite Pfizer's suceess, the company in the industry. Not only have many drug companies' has faced many challenges over the last few decades. The blocibuster drugs gone off patent in recent years, but the pharmaceutical industry is heavily infleenced by legal, reductions in R\&D spending have resulted in drug pipepolitical, and technological forces, and all indications are lines that have failed to produce anything of significant, that the industry will continue to experience dramatic value." The number of new drugs approved by the FDA changes. Per billion dollars of R\&D expenditures has halved every. Since the passing of the Food and Drug Act in 1906, nine years since 1950." The rapid increase in the cost of the Food and Drug Administration (FDA) has had reg. drug development and the reduction in the approval freulatory authority over drugs in the United States. The quency of blockbuster-level drugs has led, many industry scope of its initial authority was limited and in 1938 experts to largely consider the current fully integrated President Roosevelt signed the Food, Drug and Cosmetic business model of large pharmaceutical companies to be Act (FD\&C) into law, which significantly expanded federal oversight of drug manufacturing and marketing. In addition to granting the FDA authority to mandate pre- Business and Strategies narket review of drugs, the FD\&C also allowed the FDA o regulate drug labeling and advertising. Then, in 1992, Like most large pharmaceutical manufacturers, Pfizer Congress passed the Prescription Drug User Fee Act, pursues a "blockbuster" business model that is heavily hich enables the FDA to collect fees from drug reliant on its R\&D pipeline to consistently develop and anufacturers to aid in funding the pre-market review launch high volume drugs-drugs with expected anmual rocess for new drug approvals." The effect of these revenues of S1 bilion or greater. " In 2012, Pfizer began restructuring its operations into a new commercial oper- Global VDecines, Oncology, and Consumer Healheare ating model. Pfizer divested its infant nutrition business Business. This segment consists of three businesses with for S11. 9 billion and spun-off its animal health unit, Zoetis. the following key elements: (1) poised for high, organic Additionally, Pfizer restructured its operations into two growh; (2) distinct specialization and operating models primary business segments: Innovative Products and in science, talent, and market approach; and (3) strucEstablished Produets. Pfizer's Innovative Products busi- tured to ideally position Pfizer to be a market leader ness is further divided into the Global Innovative Pharma on a global basis." Consumer products include Advil', (GIP) and Global Vaccines, Oncology, and Consumer Centrum', Robitussin', Nexium', and ChapStick:. Healtheare (VOC) businesses." Ian Read commented regarding the restructuring: "This represents the next Established Products Business steps in Pfizer's joumey to further revitalize our innovas Global Established Pharma (GEP) Business. This areacontivecore. Our new commercial model will provide each sists of three primary product segments: (1) Peri-LOE business with enhanced ability to respond to market products which are losing or approaching a losing dynamies, greater visibility and focus, and distinctive position in market exclusivity; (2) legacy established capabitilies" Exhibit 1 contains some useful financial products in developed markets that have lost market comparisons between Pfizer's Innovative Products and exclusivity and those with growth opportunities; and its Established Products. (3) emerging market products with growth opportunities Innovative Products Business suchasorganicinitiatives, partnerships, product enhanceGlobal Innovative Pharma (GIP) Business. This busi- established products include Celebrex', EpiPen', Zoloft', nessfocuses on developing, registering and commer- and Lypitor'. cializing novel, value-creating medicines that improve patients' lives. Therapeutic areas include inflamma- Pricing Strategy tion, cardiovascular/metabolic, neuroscience and Pfizer's and other large drug companies' revenue growt! pain, rare diseases and women's/men's health, and has been largely dependent on raising the price of olde include leading brands, such as Xeljanz', Eliquis', drugs, particularly those nearing patent expiration ind Lyrica: GIP has a robust pipeline of medicines in Approximately 34% of Pfizer's revenue growth over th nflammation, cardiovascular/metabolic disease, pain, past three years has come from increasing prices and rare diseases. .6 existing drugs." Over this period, Pfizer has increase the price of Viagra by 57%, of Lyrica by 51%, and of 2016: Pfizer acquires Anacor Pharmaceuticals for Premarin by 41%. A 2013 study by the AARP found that S5. I billion for their topical anti-inflammatory the price of Lipitor rose by 9.3% in the year preceding drugs and acquires the righits to Crisaborole.? patent expiration, and by 17.5% in 2011. the year of expiration. 20 Pfizer is not alone in these practices. AbbVie and Bristol-Myers Squibb have both been reported as generating a very significant amount of their revenue growth from price increases. Drug pricing seandils and in general makes Pfizer's reliance on pricing strategy the company faces a Competitive disadvantage with increased media and societal atrention on drug pricing to drive top-line revenue growth unsustainable. This is foreign rivals that have significantly lower tax bilis. evident in the drug industry's flat net pricing in2015." fhese sort's of deals are called corporate inversions- fransactions undergone by a U.S. company that moves Growth Stritegy tis residence to a foreign country in order to reduce PGither. with U.S. taxes.'] In 2014, Pizer attempted a merzer with Growth Strategy mergers and acquisitions (M\&A). (Pfizer's acquisitions lawinakers on either side. In the end, Pfizer way from the STI8 bilion deal affer tecetion by its capabilities and acquiring brands with strong rey- In2016Pfizerenteredintoanagreementtomengetstrizenoeasbodrd."? envesilMany of Plizer's acquisitions have provided with Allergan. The S160 billion denl would have created new capabilities for the organization, such as biolog- With thirgest pharmaceutical company in the world and ies with the acquisition of Wamer-Lambert in 2000 the largest phald have allowed Pfizer to relocate its headquarters and biosimilar drugs with the acquisition of Hospira would to Allergan's home country of Ireland in order to take in 2015. Additionally, Pfizer acquired the rights to advantage of their lower corporate tax rate. 29 However, the best-selling drug Lipitor in its 2000 acquisition of on April 4,2016, the U.S. Department of Treasury took Wamer-Lambert and the rights to Celebrex and Bextra measures to limit corporate inversions. Previously, a in its 2003 acquisition of Pharmacia Corporation. From company realized tax benefits for inversions only when Pfizer's press releases and company history, abrief time- come foreign company would contribute 20% or greater line of Pfizer's major acquisitions (and divestitures) is of the combined company's assets. The new ruling disoutlined below 2+ 2000: Pfizer acquires Wamer-Lambert for 590 bil- foreign entity when determining the foreign company's lion for their biologies and consumer prod- relative size under the combined entity. The new rule ucts portfolio, along with the rights to Lipitor. was the predominant factor that caused Pfizer to pay ucts portfolio, along with the righis toLipitor. WIS0 million to walk away the Allergan deal." Pfizer 2003: Pfizer acquires Pharmacia Corporation for $60 billion and acquires the rights to Celebrex, would not have realized the full tax benefit of the irver$60 billion and acquires the rights to Celebrex, would not have realized the full tax benefit of the fallen- Bextra, Detrol, and Xalatan. 2005: Pfizer acquires Vicuron Pharmaceuticals for below the 2096 threshold under the new tax rules. $1.9 bilion for their antibiotic research and development. 2006: Pfizer sells its consumer products division to Pfizer has a long history of investing in R\&D for the Jolinson \& Johnson for S16.6 billion. development of blockbuster drigs. However, many 2007: Pfizer acquires Coley Pharmaceutical for $164 industry experts believe the age of blockbuster drugs million for their portfolio of biotechnology, has come to an end and that new blockbusters will be cancer, and vaccine drugs. 2009: Pfizer acquires Wyeth for $68 billion for their ary drugs have been mostly exploited, with very few 2009: Pfizer acquires Wyeth for 568 bilion for their ary drugs have been mostly exploied, with very few ean portfolio of biotech drugs. areas of medicine in which breakthrough drugs can 2010: Pfizer acquires King Pharmaceuticals for have a huge impact. In light of industry trends, Pfizer, \$3.6 billion and acquires the rights to EpiPen. has shifted its strategy of maintaining an industrys 15. Pfizer Acquires Hospira for $16 billion for leading drug pipeline from in-house development to their biosimilar and iniectable drugs portfolio, belng more reliant on strategic partnerships and mergers as well as infusion technologies." To support its interest in strategic partnerships, in and Analytics, and within that role she was part of the 2004 Pfizer founded Pfizer Venture Investments (PVI), task force that "redesigned Pfizer's R\&D organization to Its goal is to identify and invest in strategic areas and strengthen its pipeline and improve efficiency" businesses at the leading edge of healtheare science and technologies. PVI started with a $50 million annual Executive VP Chief Development Officer, Rod budget and was Pfizer's way of staying ahead of industry MacKenzie, PhD. Rod MacKenze received his PhD trends and investing in companies which are developing from Imperial College, London, after getting his chemcompounds and technologies that will enhance Pfizer's istry degree from the University of Glasgow. As the codrug pipeline and help drive the future of the pharma- inventor of Darifenacin, which was sold in 2003 due ceutical industry." In January 2016, Pfizer announced to regulatory issues, MacKenzie held various positions that it would be expanding its investment strategy to within Pfizer before assuming his current position." include investments in early-stage scientific innova- His role oversees "the development and advancement tions in immuno-oncology, gene therapy, and other of Pfizer's pipeline of medicines in several therapeutic cutting-edge fields. Pfizer invested nearly $46 millions areas"He serves on the PortfolioStrategy and Investment in four companies in these fields: BioAtla, NexiCGue Committee and sits on the Board of Directors for ViiV lie; Cortexyme tne, and 4D Molecular Therapists, Inc. Healthcare." Pfizer's strategic partnerstip with these and other fifios provides aworldlass resource in start-up organizations Executive VP Business Operations and CFO, to accelerate the pace of sctentiftc ninovation and to help Frank D'Amelio. Frank D'Amelio joined the company develop their pipeline of drugs," in September 2007 and oversees finance, business devel. Inside Pfizer opment, and business operations. He has been ranked as a top CFO for various years by Institutional Investor magnine. He has ied the organization in many mergers, CEO, Ian C. Read, lan C. Read was elected CEO of spin-offs, and sales, such as: Pfizer and Wyeth merger, Pfizer in December of 2010 and Chairman of the Board sale of their nutrition business, and the spin-off of Zoetis. in 2011, taking over from Jeffrey Kindler. Read has spent Herd Herience comes from his maty leaderahip roles of his entire career at Pfizer, starting as an operational audi. Of Integration, including Senior Executive Vice President tor. Read's B.S. in chemical engineering and accounting experienceas COOofLucent Technologies. Frankearned experience set the groundwork for a successful career his MBA in Finance from St John's University and his in pharmaceuticals. Some of his previous roles included bachelor's degree in Accounting from St. Peter's College. CFO ofPfizer Mexico, Country Manager of Pfizer Brazil, Representing Pfizer, he currently serves on the Board of President of Pfizer's International Pharmaceuticals Group, Directors formany organizations. They include, Humana, Executive Vice President of Europe, and Corporate Vice Inc, Zoetis, Inc, the Independent College Pund of New. President. Read also serves on the boards of Pharmaceutical Jersey, and the Gillen-Brewer School." Research Manufacturers of America (PhRMA), which represents the leading innovative biopharmaceutical Major Shareholders research companies." Pfizer is a publicly traded company with approximatcly 6.2 billion shares outstanding at December 31,2015 ,. Executive VP Strategy Portfolio and Commercial According to Yahoo Finance, among Pfizer's primary Operations, Laurie J. Olso. Laurie Oslo oversees shareholders are institutional investment companies long-term strategy, execution of commercial objec- Vanguard Group, Inc., BlackRock Institutional Trust tives, and advises portfolio functions for R\&D invest- Company, and JPMorgan Chase \& Co. who own 6.32\%, ment strategies. She started working for Pfizer in 19874.95%, and 1.89% of total outstanding shares, respecin Marketing Research. As an economics graduate from tively. Additionally, Pfizer's only major non-institutional the State University of New York at Stony Brook and shareholders are all executive-levelleadership within the with a MBA from Hofstra University, her experiences organization. span across domestic and global leadership positions in marketing, commercial development, strategy, analytics Human Resources corporate responsibility, and operations. Her most recent Human resource efforts are led by Charles H. Hill III, role was Senior Vice President of Portfolio Management who has beenthe Executive Vice President of Worldwide

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts