Question: Please use template (: Page 1024 Problem 22-4A Departmental contribution to income P3 Vortex Company operates a retail store with two departments. Information about those

Please use template (:

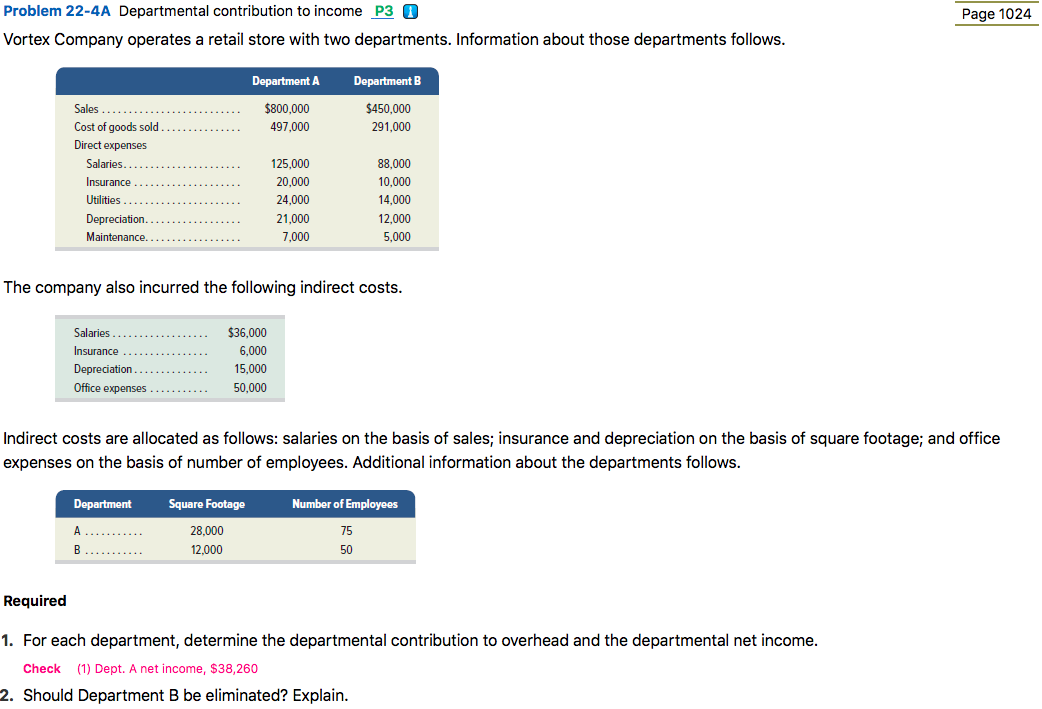

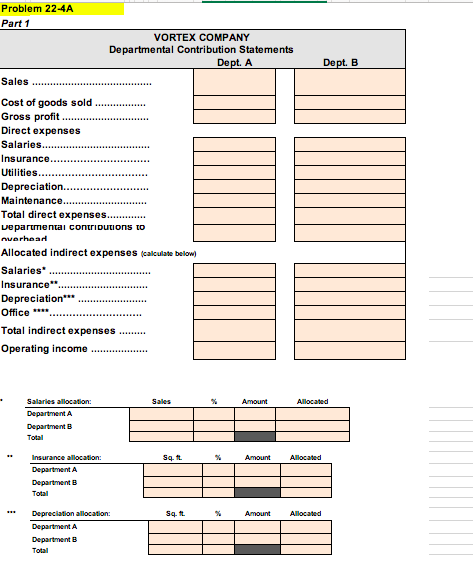

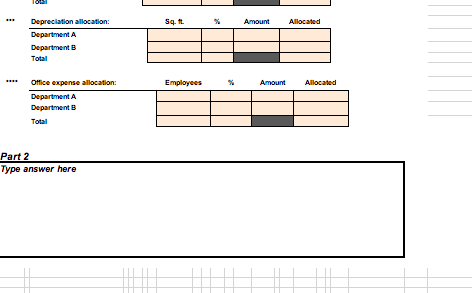

Page 1024 Problem 22-4A Departmental contribution to income P3 Vortex Company operates a retail store with two departments. Information about those departments follows. Department A Department B $800,000 497,000 $450.000 291,000 Sales Cost of goods sold Direct expenses Salaries Insurance Utilities 125,000 20,000 24,000 21,000 7,000 88,000 10,000 14.000 12.000 5,000 Depreciation. Maintenance. The company also incurred the following indirect costs. Salaries Insurance Depreciation Office expenses ........... $36,000 6,000 15,000 50.000 Indirect costs are allocated as follows: salaries on the basis of sales; insurance and depreciation on the basis of square footage; and office expenses the of nun of employees. Additional information about the departments follows. Department Square Footage Number of Employees A B 28.000 12,000 75 50 Required 1. For each department, determine the departmental contribution to overhead and the departmental net income. Check (1) Dept. A net income, $38,260 2. Should Department B be eliminated? Explain. Problem 22-4A Part 1 VORTEX COMPANY Departmental Contribution Statements Dept. A Dept. B Sales Cost of goods sold Gross profit Direct expenses Salaries... Insurance.. Utilities.... Depreciation.. Maintenance.. Total direct expenses...... Departmental contributions to nverhaal Allocated indirect expenses calculate below) Salaries Insurance" Depreciation Office *** Total indirect expenses ....... Operating income - Sales Amount Allocated Salaries allocation: Department A Department B Total Sq. ft. Amount Allocated Insurance allocation: Department A Department B Total Sq. ft. Amount Allocated Depreciation allocation: Department A Department B Total Sq.tt % Amount Allocated Depreciation allocation: Department A Department B Total Employees Amount Allocated Office expense allocation: Department A Department B Total Part 2 Type answer here

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts