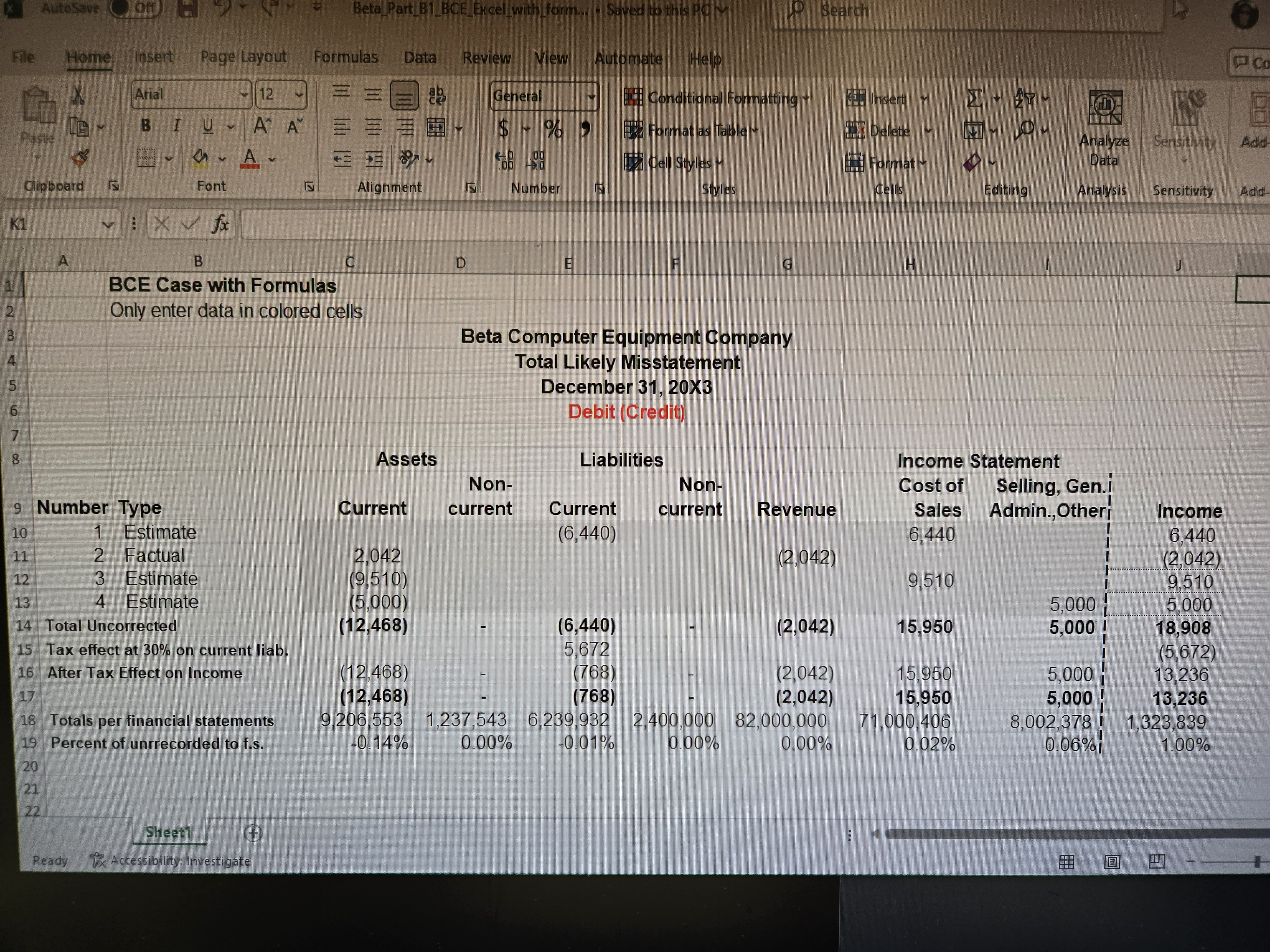

Question: Please use the above image to answer the questions Beta Computer Equipment CompanyAccounting Issues CasePart B1. Assume a 30% tax rate, and the Totals per

Please use the above image to answer the questions Beta Computer Equipment CompanyAccounting Issues CasePart B1. Assume a 30% tax rate, and the Totals per financial statements provided. Complete the following schedule as per Figure 16.4 (p. 718) in the text. Assume that the Totals per financial statements (second to bottom row) have appropriately been entered on this schedule from the financial statements. 2. Assume that the client does not intend to record any of the above misstatements and that 4.0 percent of income after taxes is considered a material misstatement. Provide the auditor's conclusion in this situation. Only consider the income effect.3. Assume that the client does intends to record correcting entries for each above misstatement. Provide the auditor's conclusion in this situation.

Beta Part_B1_BCE_Excel with form... . Saved to this PC Search File Home Insert Page Layout Formulas Data Review View Automate Help CO Arial 12 General Conditional Formatting Insert B IU- AA $ 1% " Delete Paste Format as Table Analyze Sensitivity Add a- A Cell Styles to Format Data Clipboard Font Alignment Number Styles Cells Editing Analysis Sensitivity Add K1 VIXVA A B C D G BCE Case with Formulas Only enter data in colored cells W Beta Computer Equipment Company Total Likely Misstatement December 31, 20X3 Debit (Credit) Assets Liabilities Income Statement Non- Non- Cost of Selling, Gen. 9 Number Type Current current Current current Revenue Sales Admin.,Otheri Income 10 Estimate (6,440) 6,440 6,440 11 2 Factual 2,042 (2,042) (2,042 12 3 Estimate (9,510) 9,510 9,510 13 4 Estimate (5,000) 5,000 5,000 14 Total Uncorrected (12,468) (6,440) (2,042) 15,950 5,000 18,908 15 Tax effect at 30% on current liab. 5,672 (5,672) 16 After Tax Effect on Income (12,468) (768) (2,042) 15,950 5,000 13,236 17 (12,468) (768 (2,042) 15,950 5,000 ! 13,236 18 Totals per financial statements 9,206,553 1,237,543 6,239,932 2,400,000 82,000,000 71,000,406 8,002,378 ! 1,323,839 19 Percent of unrrecorded to f.s. -0.14% 0.00% -0.01% 10.00% 0.00% 0.02% 0.06% 1.00% 20 21 22 Sheet1 Ready Accessibility: Investigate

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts