Question: please use the account list, debit card expense was wrong A company has determined that the length of time a receivable is outstanding is the

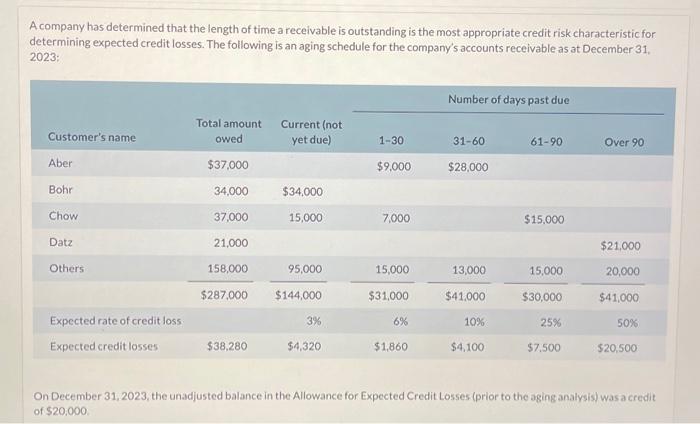

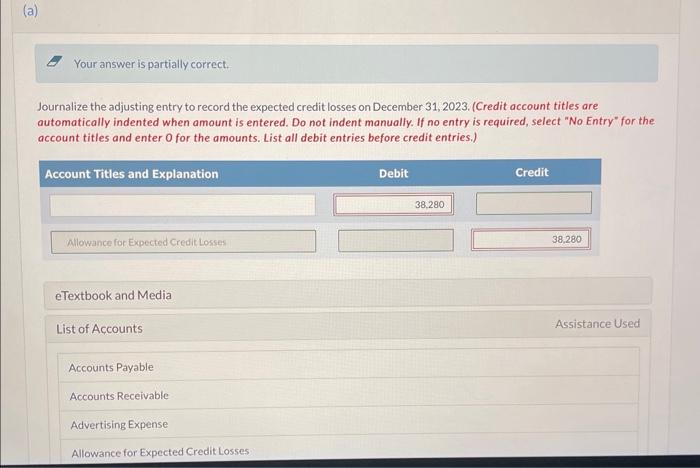

A company has determined that the length of time a receivable is outstanding is the most appropriate credit risk characteristic for determining expected credit losses. The following is an aging schedule for the company's accounts receivable as at December 31. 2023: On December 31,2023, the unadjusted balance in the Allowance for Expected Credit Losses (prior to the aging analysis) was a credit of $20,000 - Your answer is partially correct. Journalize the adjusting entry to record the expected credit losses on December 31, 2023. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts. List all debit entries before credit entries.) Allowance for Expected Credit Losses Bank Charges Expense Bank Loan Payable Cash Credit Losses Debit Card Expense Income Tax Receivable Insurance Expense Interest Expense Interest Revenue No Entry Notes Payable Notes Receivable Sales Revenue Utilities Expense

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts