Question: Please use the Constant Growth Dividend Discount Model to answer this question. An investor can currently purchase one share of XYZ common stock for $33.

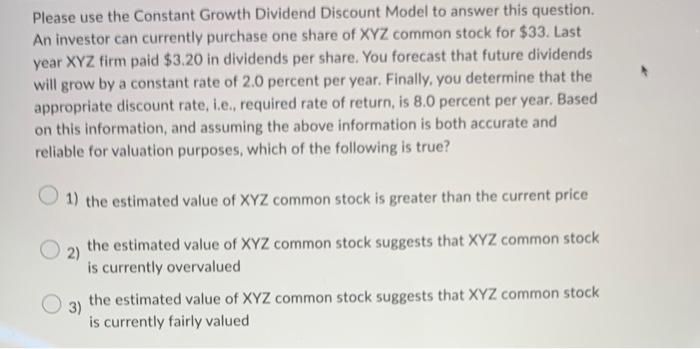

Please use the Constant Growth Dividend Discount Model to answer this question. An investor can currently purchase one share of XYZ common stock for $33. Last year XYZ firm paid $3.20 in dividends per share. You forecast that future dividends will grow by a constant rate of 2.0 percent per year. Finally, you determine that the appropriate discount rate, i.e., required rate of return, is 8.0 percent per year. Based on this information, and assuming the above information is both accurate and reliable for valuation purposes, which of the following is true? 1) the estimated value of XYZ common stock is greater than the current price 2) the estimated value of XYZ common stock suggests that XYZ common stock is currently overvalued 3) the estimated value of XYZ common stock suggests that XYZ common stock is currently fairly valued

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts