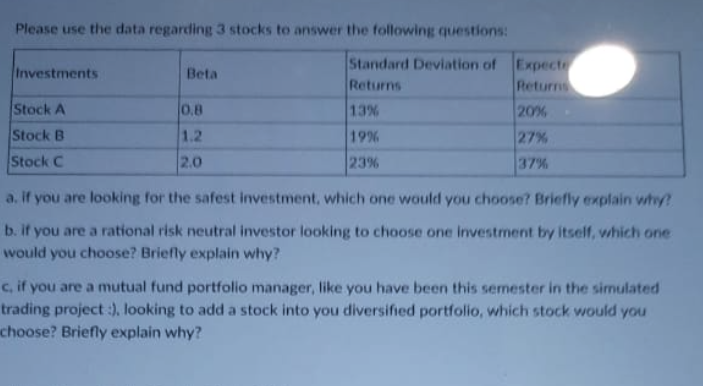

Question: Please use the data regarding 3 stocks to answer the following questions: Investments Beta Stock A 0.8 Standard Deviation of Expecte Returns Returns 13 20%

Please use the data regarding 3 stocks to answer the following questions: Investments Beta Stock A 0.8 Standard Deviation of Expecte Returns Returns 13 20% 1996 27% 23% 37% 1.2 Stock B Stock C 2.0 a. If you are looking for the safest Investment, which one would you choose? Briefly explain why? b. if you are a rational risk neutral investor looking to choose one investment by itself, which one would you choose? Briefly explain why? c. if you are a mutual fund portfolio manager, like you have been this semester in the simulated trading project:). looking to add a stock into you diversified portfolio, which stock would you choose? Briefly explain why

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts