Question: Please use the description above to fill out the table below. Please show calculations and or excel formulas for answers. :) - You want to

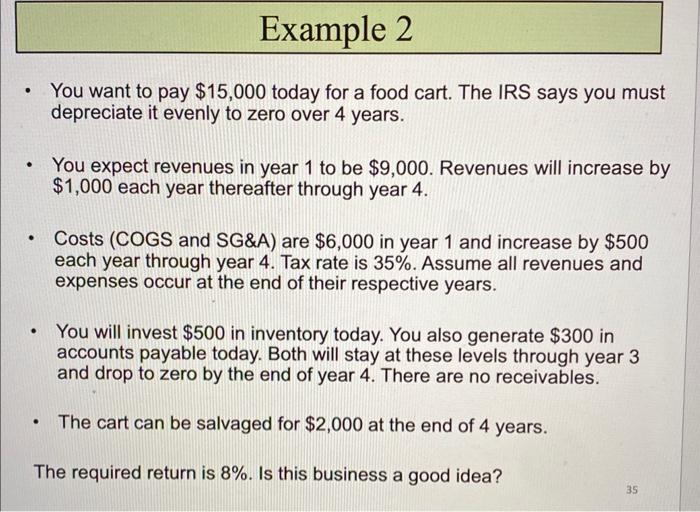

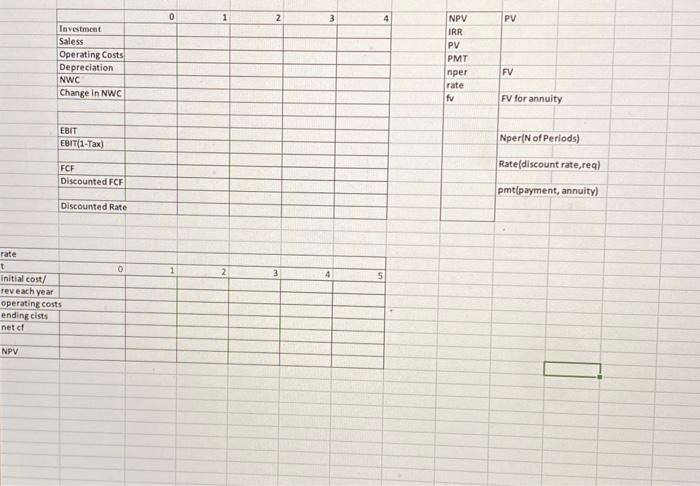

- You want to pay $15,000 today for a food cart. The IRS says you must depreciate it evenly to zero over 4 years. - You expect revenues in year 1 to be $9,000. Revenues will increase by $1,000 each year thereafter through year 4 . - Costs (COGS and SG\&A) are $6,000 in year 1 and increase by $500 each year through year 4. Tax rate is 35%. Assume all revenues and expenses occur at the end of their respective years. - You will invest $500 in inventory today. You also generate $300 in accounts payable today. Both will stay at these levels through year 3 and drop to zero by the end of year 4 . There are no receivables. - The cart can be salvaged for $2,000 at the end of 4 years. The required return is 8%. Is this business a good idea? \begin{tabular}{|l|l|l|l|l|l|} \hline \multicolumn{1}{|c|}{0} & 1 & \multicolumn{1}{|c|}{} \\ \hline Investment & & & & \\ \hline Saless & & & & \\ \hline Operating Costs & & & & \\ \hline Depreciation & & & & \\ \hline NWC & & & & \\ \hline Change in NWC & & & & \\ \hline & & & & \\ \hline EBIT & & & & \\ \hline EBrT(1-Tax) & & & & \\ \hline FCF & & & & \\ \hline Discounted FCF & & & & \\ \hline & & & & \\ \hline Discounted Rate & & & & \\ \hline \end{tabular} \begin{tabular}{|l|l} \hline NPV & PV \\ \hline IRR & \\ \hline PV & \\ \hline PMT & \\ nper & FV \\ rate & \\ \hline fv & FV for annuity \\ \hline \end{tabular} Nper(N of Periods) Rate(discount rate, req) pmt(payment, annuity)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts