Question: please use the example to solve the problem. And explain step by step! WRITE THE 9 DIGITS YOUR NIA USING THE 9 CELLS Example: N1

please use the example to solve the problem. And explain step by step!

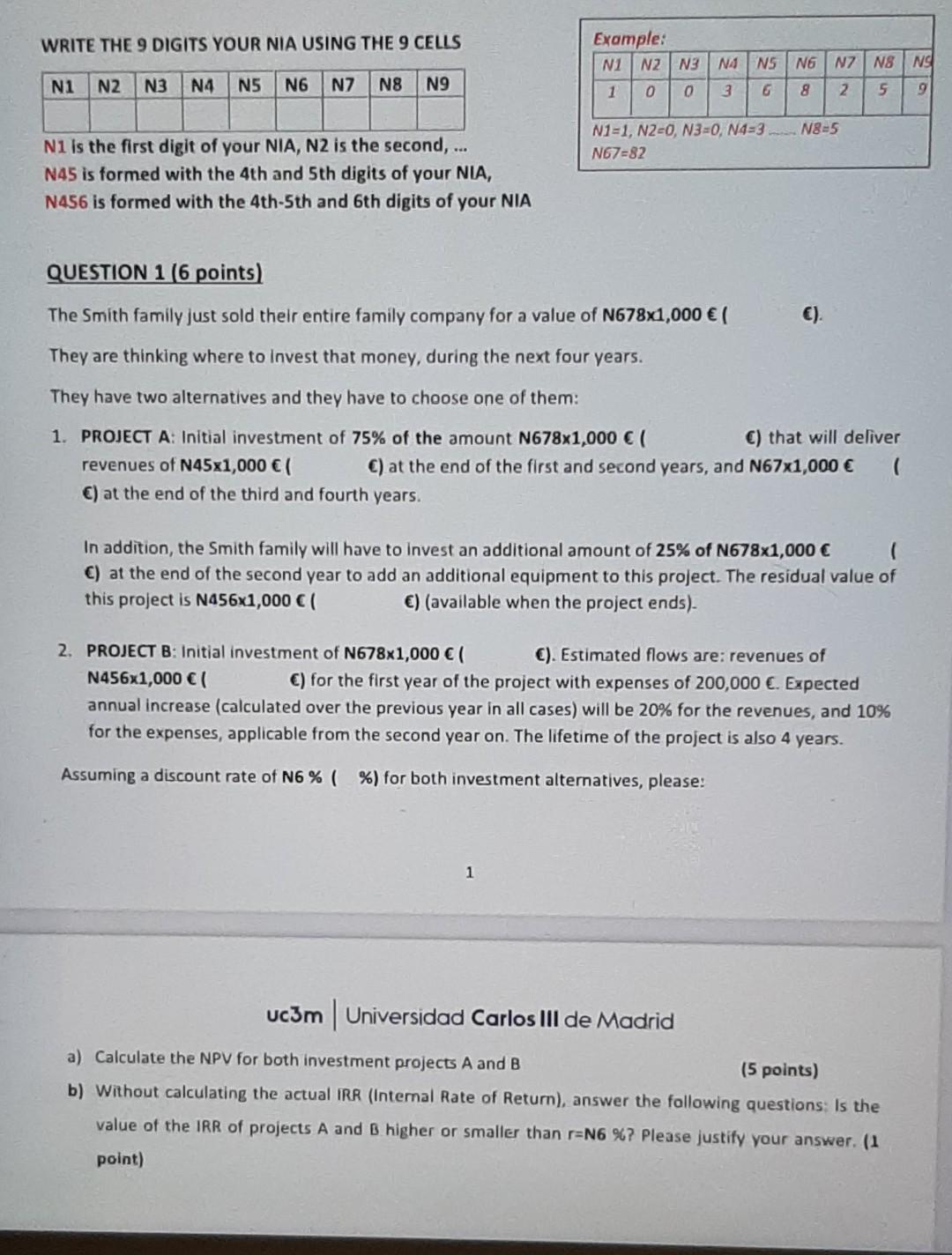

WRITE THE 9 DIGITS YOUR NIA USING THE 9 CELLS Example: N1 N2 N3 N4NS N6 N7N8 1 0 0 3 8 2 5 NI N1 N2 N3 N4 N5 N6 N7 N8 N9 9 N1=1, N2=0, N3=0, N4= 3N8=5 N67=82 Ni is the first digit of your NIA, N2 is the second, ... N45 is formed with the 4th and 5th digits of your NIA, N456 is formed with the 4th-5th and 6th digits of your NIA QUESTION 1 (6 points) The Smith family just sold their entire family company for a value of N678x1,000 ). They are thinking where to invest that money, during the next four years. They have two alternatives and they have to choose one of them: 1. PROJECT A: Initial investment of 75% of the amount N678x1,000 ) that will deliver revenues of N45x1,000 ) at the end of the first and second years, and N67x1,000 ( C) at the end of the third and fourth years. In addition, the Smith family will have to invest an additional amount of 25% of N678x1,000 ( C) at the end of the second year to add an additional equipment to this project. The residual value of this project is N456x1,000 ( ) (available when the project ends). 2. PROJECT B: Initial investment of N678x1,000 ( C). Estimated flows are: revenues of N456x1,000 ) for the first year of the project with expenses of 200,000 . Expected annual increase (calculated over the previous year in all cases) will be 20% for the revenues, and 10% for the expenses, applicable from the second year on. The lifetime of the project is also 4 years. Assuming a discount rate of N6% (%) for both investment alternatives, please! 1 Uc3m | Universidad Carlos III de Madrid a) Calculate the NPV for both investment projects A and B (5 points) b) without calculating the actual IRR (Internal Rate of Return), answer the following questions: Is the value of the IRR of projects A and B higher or smaller than r=N6 %? Please justify your answer. (1 point) WRITE THE 9 DIGITS YOUR NIA USING THE 9 CELLS Example: N1 N2 N3 N4NS N6 N7N8 1 0 0 3 8 2 5 NI N1 N2 N3 N4 N5 N6 N7 N8 N9 9 N1=1, N2=0, N3=0, N4= 3N8=5 N67=82 Ni is the first digit of your NIA, N2 is the second, ... N45 is formed with the 4th and 5th digits of your NIA, N456 is formed with the 4th-5th and 6th digits of your NIA QUESTION 1 (6 points) The Smith family just sold their entire family company for a value of N678x1,000 ). They are thinking where to invest that money, during the next four years. They have two alternatives and they have to choose one of them: 1. PROJECT A: Initial investment of 75% of the amount N678x1,000 ) that will deliver revenues of N45x1,000 ) at the end of the first and second years, and N67x1,000 ( C) at the end of the third and fourth years. In addition, the Smith family will have to invest an additional amount of 25% of N678x1,000 ( C) at the end of the second year to add an additional equipment to this project. The residual value of this project is N456x1,000 ( ) (available when the project ends). 2. PROJECT B: Initial investment of N678x1,000 ( C). Estimated flows are: revenues of N456x1,000 ) for the first year of the project with expenses of 200,000 . Expected annual increase (calculated over the previous year in all cases) will be 20% for the revenues, and 10% for the expenses, applicable from the second year on. The lifetime of the project is also 4 years. Assuming a discount rate of N6% (%) for both investment alternatives, please! 1 Uc3m | Universidad Carlos III de Madrid a) Calculate the NPV for both investment projects A and B (5 points) b) without calculating the actual IRR (Internal Rate of Return), answer the following questions: Is the value of the IRR of projects A and B higher or smaller than r=N6 %? Please justify your answer. (1 point)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts