Question: Please use the Excel to solve this question The date is 3 September 2014. You are considering the purchase of a bond with face value

Please use the Excel to solve this question

Please use the Excel to solve this question

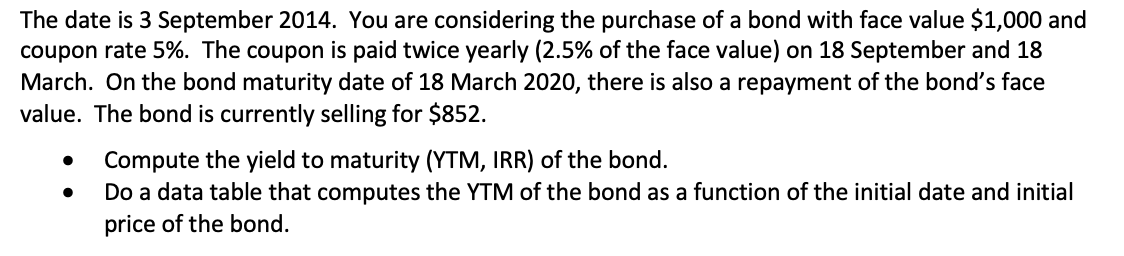

The date is 3 September 2014. You are considering the purchase of a bond with face value $1,000 and coupon rate 5%. The coupon is paid twice yearly ( 2.5% of the face value) on 18 September and 18 March. On the bond maturity date of 18 March 2020, there is also a repayment of the bond's face value. The bond is currently selling for $852. - Compute the yield to maturity (YTM, IRR) of the bond. - Do a data table that computes the YTM of the bond as a function of the initial date and initial price of the bond

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts