Question: Please use the financial statement effects template below to answer the questions. Thanks! Question #2: The October transactions were as follows. Oct. 5 Received $1,300

Please use the financial statement effects template below to answer the questions. Thanks!

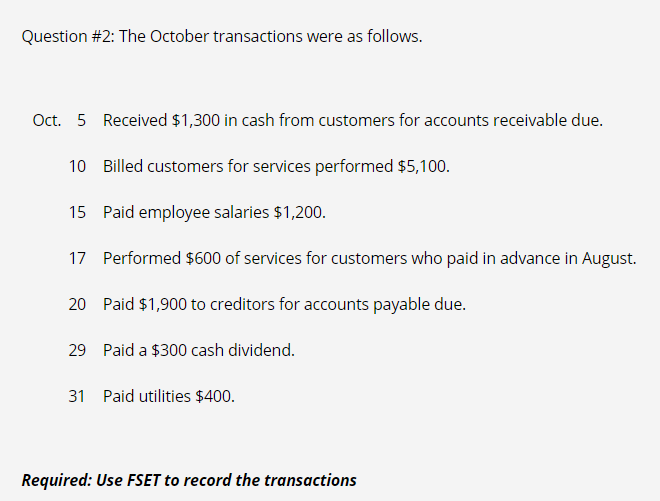

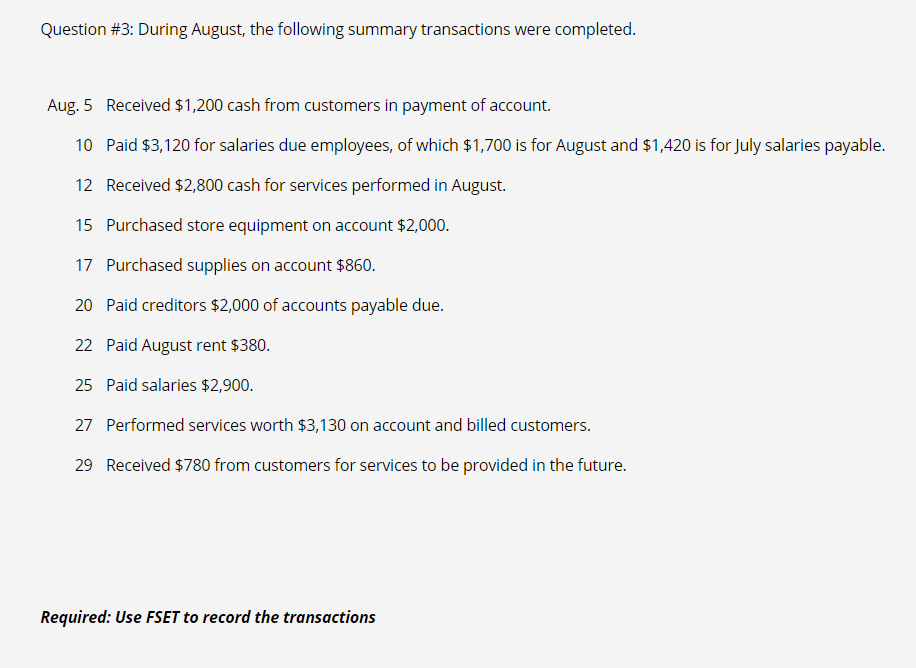

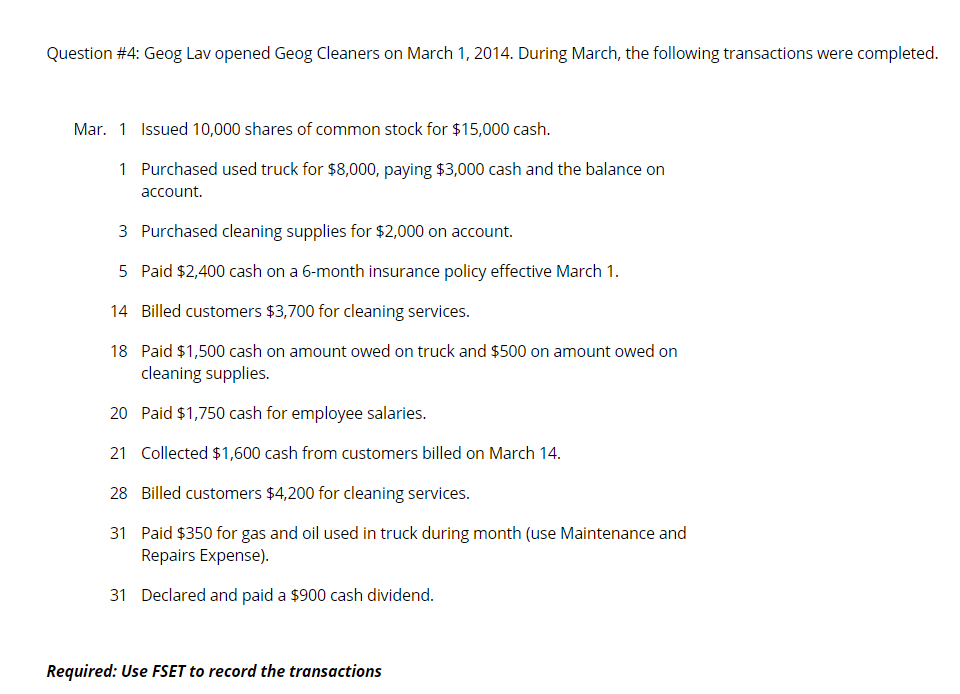

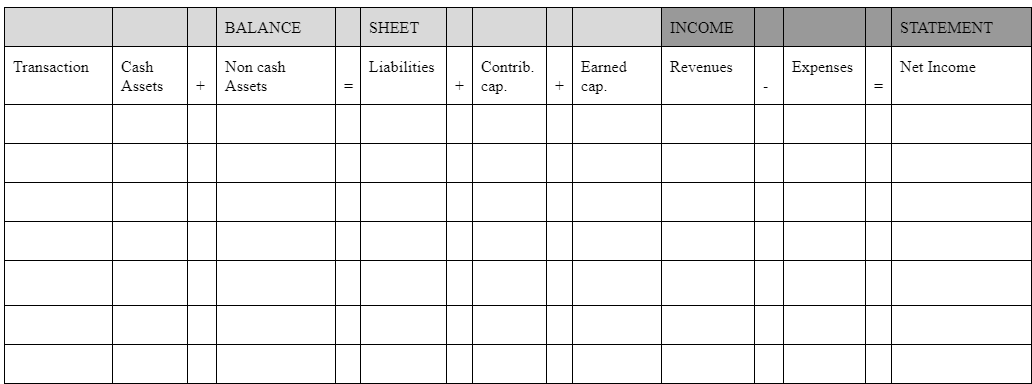

Question #2: The October transactions were as follows. Oct. 5 Received $1,300 in cash from customers for accounts receivable due. 10 Billed customers for services performed $5,100. 15 Paid employee salaries $1,200. 17 Performed $600 of services for customers who paid in advance in August. 20 Paid $1,900 to creditors for accounts payable due. 29 Paid a $300 cash dividend. 31 Paid utilities $400. Required: Use FSET to record the transactions Question #3: During August, the following summary transactions were completed. Aug. 5 Received $1,200 cash from customers in payment of account. 10 Paid $3,120 for salaries due employees, of which $1,700 is for August and $1,420 is for July salaries payable. 12 Received $2,800 cash for services performed in August 15 Purchased store equipment on account $2,000. 17 Purchased supplies on account $860. 20 Paid creditors $2,000 of accounts payable due. 22 Paid August rent $380. 25 Paid salaries $2,900. 27 Performed services worth $3,130 on account and billed customers. 29 Received $780 from customers for services to be provided in the future. Required: Use FSET to record the transactions Question #4: Geog Lav opened Geog Cleaners on March 1, 2014. During March, the following transactions were completed. Mar. 1 Issued 10,000 shares of common stock for $15,000 cash. 1 Purchased used truck for $8,000, paying $3,000 cash and the balance on account. 3 Purchased cleaning supplies for $2,000 on account. 5 Paid $2,400 cash on a 6-month insurance policy effective March 1. 14 Billed customers $3,700 for cleaning services. 18 Paid $1,500 cash on amount owed on truck and $500 on amount owed on cleaning supplies. 20 Paid $1,750 cash for employee salaries. 21 Collected $1,600 cash from customers billed on March 14. 28 Billed customers $4,200 for cleaning services. 31 Paid $350 for gas and oil used in truck during month (use Maintenance and Repairs Expense). 31 Declared and paid a $900 cash dividend. Required: Use FSET to record the transactions BALANCE SHEET INCOME STATEMENT Transaction Liabilities Revenues Cash Assets Net Income Non cash Assets Expenses Contrib . . Earned

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts