Question: please use the following calculations to answer why it is beneficial cor a company to invest, how compound interest works, explain two different forcasting plans

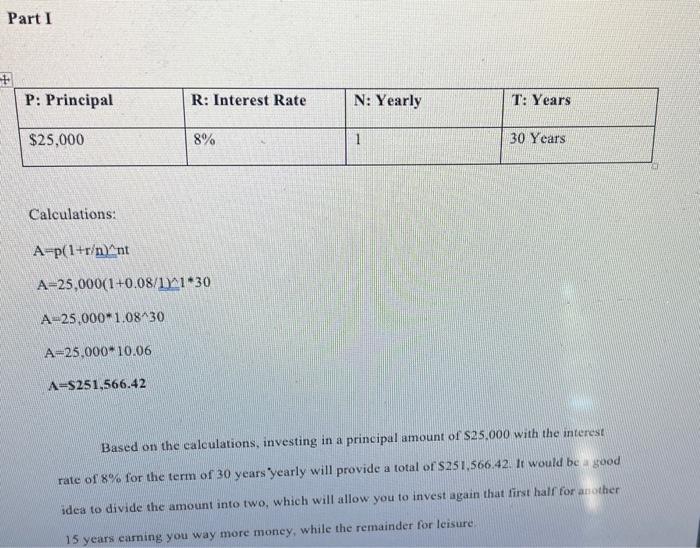

Third, reflect on your calculations and present your financial guidance in a project report. You will make two different plans based on an aggressive and conservative forecast of the market. (You may also make a combination of the two rates, allocating different investment amounts that total your initial capital.) Your project report should contain the following: Introduction: One paragraph describing how investment could be beneficial to the company. Three body paragraphs addressing each of the following: . Explain how compound interest works in your own words. Explain the two different forecasting plans with pros and cons for each. Present your calculations for each plan. Be sure to state the formula and outputs. . Conclusion: One paragraph summarizing your financial considerations and findings and their significance to the company. Part I + P: Principal R: Interest Rate N: Yearly T: Years $25,000 8% 1 30 Years Calculations: A-p(1+rinn A-25,000(1+0.08/1711.30 A-25,000*1.08430 A-25,000*10.06 A-$251.566.42 Based on the calculations, investing in a principal amount of $25.000 with the interest rate of 8% for the term of 30 years yearly will provide a total of 251.566.42. It would be good idea to divide the amount into two, which will allow you to invest again that first half for another 15 years earning you way more money, while the remainder for leisure

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts