Question: Please use the following formulas to answer the question: 8. There are two stocks: A and B, and Treasury Bill (TB). The parameters of these

Please use the following formulas to answer the question:

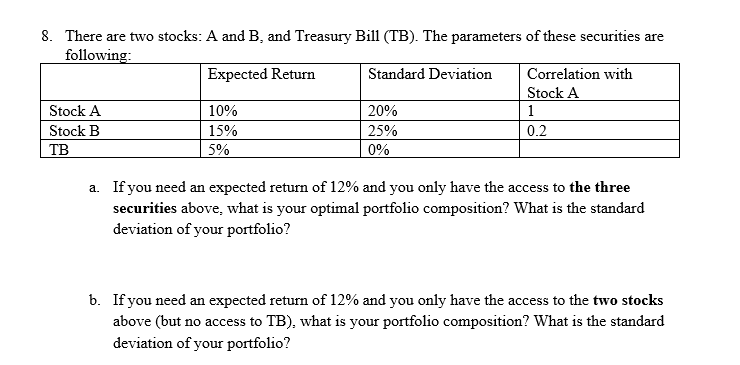

8. There are two stocks: A and B, and Treasury Bill (TB). The parameters of these securities are following: Expected Return Standard Deviation Correlation with Stock A Stock A 10% 20% Stock B 15% 25% 0.2 | 5% 0% a. If you need an expected return of 12% and you only have the access to the three securities above, what is your optimal portfolio composition? What is the standard deviation of your portfolio? b. If you need an expected return of 12% and you only have the access to the two stocks above (but no access to TB), what is your portfolio composition? What is the standard deviation of your portfolio? 1. Arithmetic average stock returns .-= (+r)x(1+r)x.X(1+r)] 1 = 19+r)*-1 2. Geometric average stock returns 3. APR versus EAR: APR = N xr EAR=(1+r)-1 Where N number of period per year r: return rate per period 4. In the scenario analysis, the expected return and variance of a stock are: E[r]=u= p(sr(s) Var[r]=o= ps(r(s)- E[r])? 5. Covariance and correlation coefficient between two securities - Covtri:] Pi Covl 1,r]=E[(-44)(1,-1)= E[Gr.-44. 6. Real vs nominal interest rate 1+R , R-i 1+R=(1+r)*(1+i)=r=1+ 1+i Where R: nominal interest rate, r: real interest rate, i: inflation rate 7. For a portfolio with two assets 1 and 2, the expected return and variance is 0; = Var[r,] = E[(", -,)(r, -4,)] 4 = Er]= w[/]+w,E[r]=W,44 + W, = wo+w202 + 2w,w.100, In the special situation where the second asset is risk free rate, = w01 8. The Sharpe ratio of a portfolio E[r]-17 S 0 9. Risk aversion of an investor: A Elrol-r; 10. Minimum variance portfolio (two securities) 03-P120,02 W +03-28120,02 11. Optimal tangency (or market) portfolio composition (two securities) (E[r]1,)-0,0,(E[7]-7) w,= To (E[r] "p)+c] (E[vi] "p) 2007(E[ri]+E[ra] 20's)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts