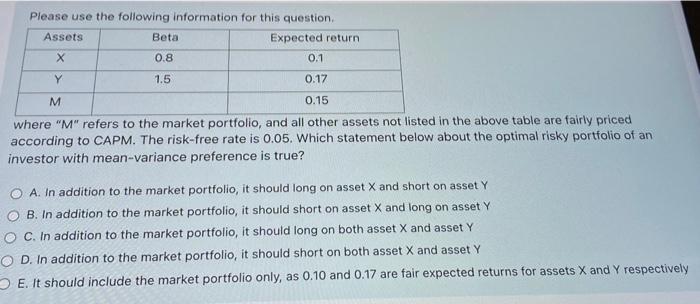

Question: Please use the following information for this question Assets Beta Expected return 0.8 0.1 Y 1.5 0.17 M 0.15 where M refers to the market

Please use the following information for this question Assets Beta Expected return 0.8 0.1 Y 1.5 0.17 M 0.15 where "M" refers to the market portfolio, and all other assets not listed in the above table are fairly priced according to CAPM. The risk-free rate is 0.05. Which statement below about the optimal risky portfolio of an investor with mean-variance preference is true? O A. In addition to the market portfolio, it should long on asset X and short on asset Y B. In addition to the market portfolio, it should short on asset X and long on asset Y C. In addition to the market portfolio, it should long on both asset X and asset Y O D. In addition to the market portfolio, it should short on both asset X and asset Y E. It should include the market portfolio only, as 0.10 and 0.17 are fair expected returns for assets X and Y respectively

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts