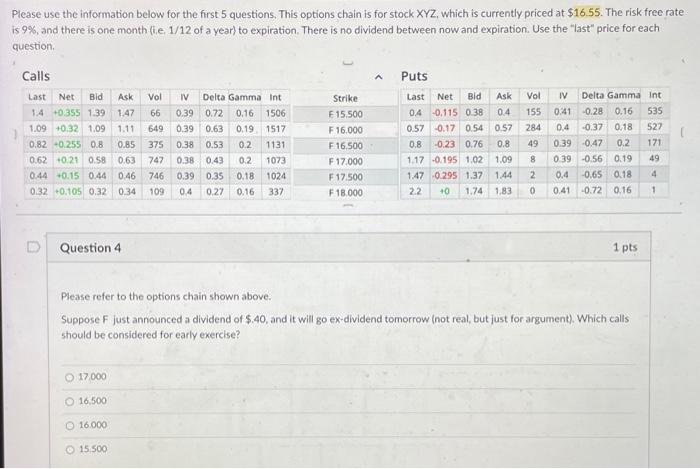

Question: Please use the information below for the first 5 questions. This options chain is for stock XYZ, which is currently priced at $16.55. The risk

Please use the information below for the first 5 questions. This options chain is for stock XYZ, which is currently priced at $16.55. The risk free rate is 9%, and there is one month (ie 1/12 of a year) to expiration. There is no dividend between now and expiration. Use the "last" price for each question Puts Ask Vol Calls Last Net Bid Ask 1.4 +0.355 139 1.47 1.09 0.32 1.09 1.11 0.82 +0.255 0.8 0.62 +0.21 0.58 0.63 0.44 +0.15 0.44 0.46 0.32 0.105 0.32 0.34 Vol IV Delta Gamma int 66 0.39 0.72 0.16 1506 649 0.39 0.63 0.19 1517 375 0.38 0.53 0.2 1131 747 0.38 0.43 1073 746 0.39 0.35 0.18 1024 109 0.4 0.22 0.16 337 Strike E15.500 F 16.000 F 16.500 F 17.000 F 17.500 F 18.000 0.85 Last Net Bid 04 -0.115 0.38 0.4 0.57 0.17 0.54 0.57 0.8 -0.23 0.76 0.8 1.17 -0.195 1.02 1.09 1.47 0.295 1.37 1.44 22 +0 1.74 1.83 155 284 49 IV Delta Gamma Int 0.41 0.28 0.16 535 0.4 -0.37 0.18 527 0.39 -0.47 0.2 171 0.39 -0.56 0.19 49 0.4 -0.65 0.18 4 0.2 8 2 0 0.41 0.72 0.16 1 Question 4 1 pts Please refer to the options chain shown above Suppose F just announced a dividend of $.40, and it will go ex-dividend tomorrow (not real, but just for argument). Which calls should be considered for early exercise? 17 000 16 500 16.000 15.500

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts