Question: Please use the information below to answer the following question. Your company has a debt to equity breakdown of 60% debt and 40% equity. The

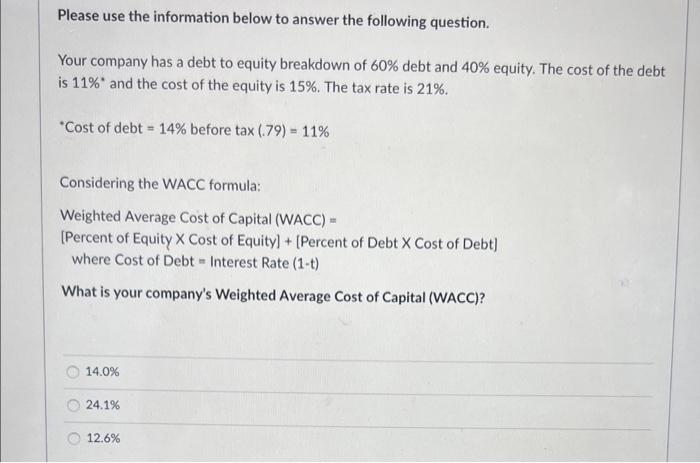

Please use the information below to answer the following question. Your company has a debt to equity breakdown of 60% debt and 40% equity. The cost of the debt is 11%' and the cost of the equity is 15%. The tax rate is 21%. *Cost of debt - 14% before tax (.79) - 11% Considering the WACC formula: Weighted Average Cost of Capital (WACC) - (Percent of Equity X Cost of Equity) + (Percent of Debt X Cost of Debt) where Cost of Debt - Interest Rate (1-t) What is your company's Weighted Average Cost of Capital (WACC)? 14.0% 24.1% 12.6%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts