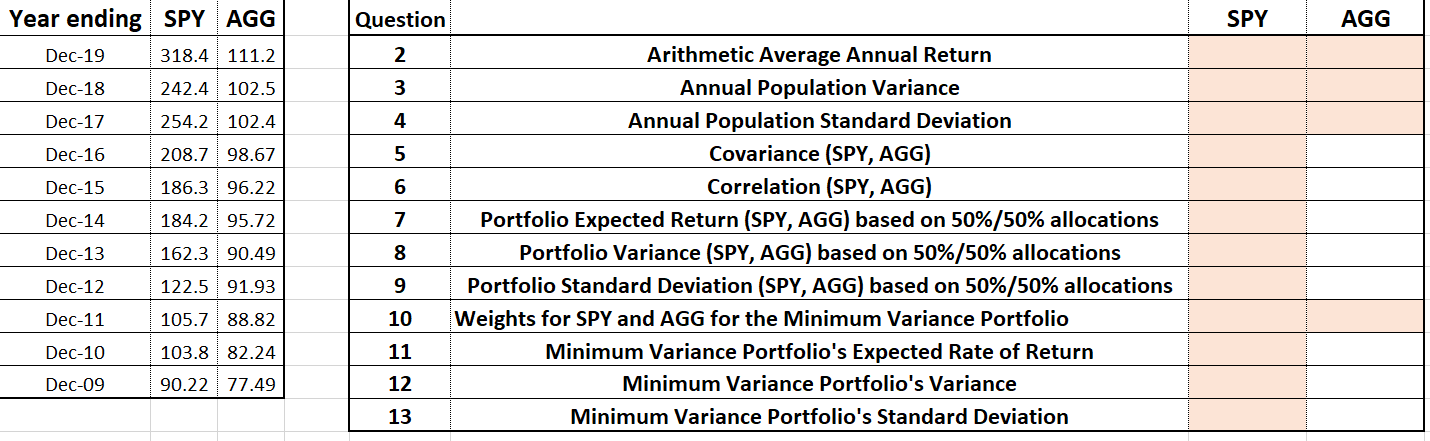

Question: Please use the information in the table on the left to answer the questions on the right with formulas shown thank you! SPY AGG Year

Please use the information in the table on the left to answer the questions on the right with formulas shown thank you!

SPY AGG Year ending SPY AGG Dec-19 318.4 111.2 Dec-18 242.4 102.5 Dec-17 254.2 102.4 Dec-16 208.7 | 98.67 Dec-15 186.3 96.22 Dec-14 184.2 | 95.72 Question 2 Arithmetic Average Annual Return 3 Annual Population Variance 4 Annual Population Standard Deviation 5 Covariance (SPY, AGG) 6 Correlation (SPY, AGG) 7 Portfolio Expected Return (SPY, AGG) based on 50%/50% allocations 8 Portfolio Variance (SPY, AGG) based on 50%/50% allocations 9 Portfolio Standard Deviation (SPY, AGG) based on 50%/50% allocations 10 Weights for SPY and AGG for the Minimum Variance Portfolio 11 Minimum Variance Portfolio's Expected Rate of Return 12 Minimum Variance Portfolio's Variance 13 Minimum Variance Portfolio's Standard Deviation Dec-13 162.3 90.49 Dec-12 122.5 91.93 Dec-11 105.7 88.82 Dec-10 103.8 82.24 Dec-09 90.22 77.49 SPY AGG Year ending SPY AGG Dec-19 318.4 111.2 Dec-18 242.4 102.5 Dec-17 254.2 102.4 Dec-16 208.7 | 98.67 Dec-15 186.3 96.22 Dec-14 184.2 | 95.72 Question 2 Arithmetic Average Annual Return 3 Annual Population Variance 4 Annual Population Standard Deviation 5 Covariance (SPY, AGG) 6 Correlation (SPY, AGG) 7 Portfolio Expected Return (SPY, AGG) based on 50%/50% allocations 8 Portfolio Variance (SPY, AGG) based on 50%/50% allocations 9 Portfolio Standard Deviation (SPY, AGG) based on 50%/50% allocations 10 Weights for SPY and AGG for the Minimum Variance Portfolio 11 Minimum Variance Portfolio's Expected Rate of Return 12 Minimum Variance Portfolio's Variance 13 Minimum Variance Portfolio's Standard Deviation Dec-13 162.3 90.49 Dec-12 122.5 91.93 Dec-11 105.7 88.82 Dec-10 103.8 82.24 Dec-09 90.22 77.49

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts